Greenpeace Report Warns of 'Greenhushing' in HKEx Climate Reporting; Pushes for Stricter HKEx Regulations

【Hong Kong, November 22, 2024】The new climate-related disclosure requirements (New Requirements) for issuers under the Hong Kong Stock Exchange (HKEx) will come into effect in phase starting next year. Greenpeace released a report, “Uncovering Gaps: the Problems and Challenges of Hong Kong's New Climate Disclosure Requirements Report” (the Report), which reveals that 55% of companies haven't fully disclosed all Scope 3 emissions data, particularly in the real estate and financial services sectors. The report argues that the new regulation has three major shortcomings, including: without mandatory disclosure requirement of all Scope 3 data, lack of independent assurance requirement, and low penalty deterrence”. These gaps may potentially lead to "greenhushing" – the underreporting or concealment of emissions data. Greenpeace calls on HKEX to mandate complete Scope 3 data disclosure for listed companies, enforce stricter third-party assurance measures, and enhance penalties to address these issues.

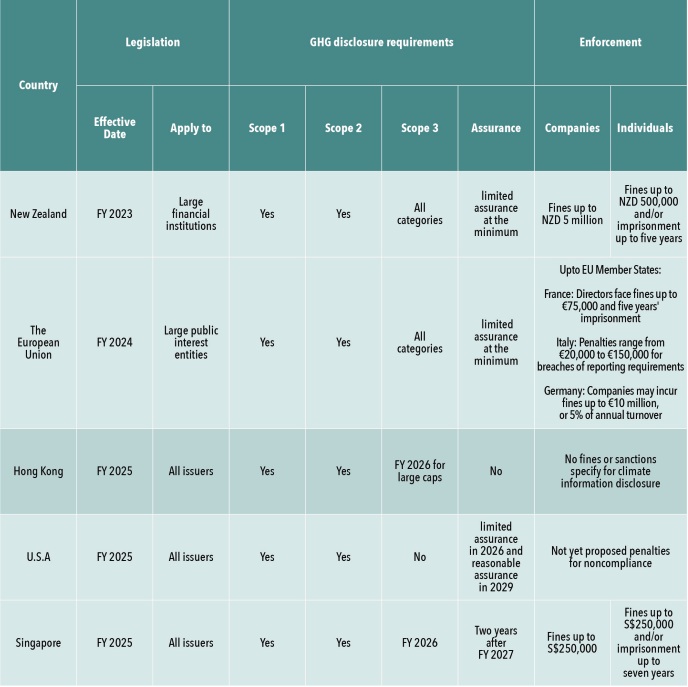

Tom Ng, Greenpeace campaigner, says, “While the HKEX's new Requirements may enhance the transparency of climate information for Hong Kong's corporations, the regulation, supervision, and penalties still lag behind those in New Zealand and the European Union. This may allow companies not to disclose or conceal key categories of emissions data, some of which could account for up to 99% of a company's total emissions. If these categories are underreported under the new requirements, it may unintentionally condone greenhushing and mislead investors and the market, making it difficult to accurately assess a corporation's true environmental impacts. This, in turn, could jeopardize Hong Kong's goal of achieving carbon neutrality by 2050 and undermine its ambition to become a leading international green finance center."

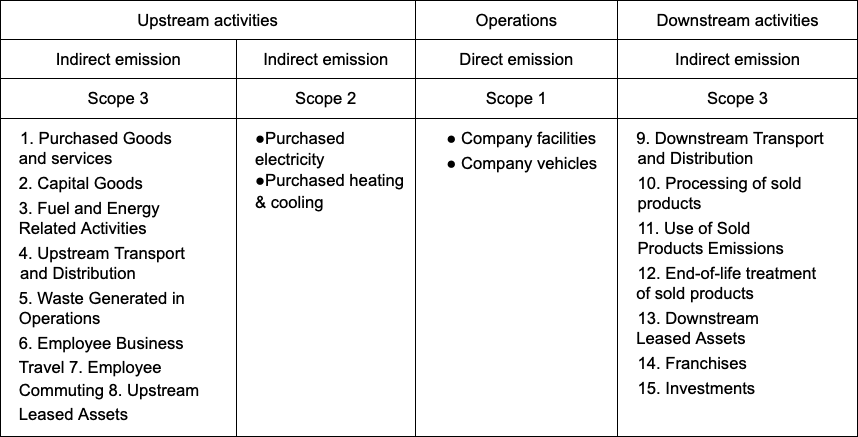

Greenpeace analyzed greenhouse gas emissions data disclosed by 113 constituents of the Hang Seng Composite LargeCap Index (as of October 2024), and found that only 63 companies disclosed Scope 3 emissions, typically the largest scope. Among them, 55% (35 companies) did not fully disclose data for all subcategories (refer to Appendix 1). The real estate and financial services sectors showed relatively poor performance1. In the real estate sector, only 36% (5 companies) disclosed data for their major sources, "Capital Goods" (Category 2)2, emissions that could account for nearly half of their total; while in the financial services sector, just 25% (3 companies) disclosed data for on their primary emission sources, "Investments" (Category 15)3, which generally accounted for more than 99% of the total emissions. This lack of transparency hampers investors from understanding whether they hold capital goods or investments that worsen climate change; it also means that the public cannot monitor the progress of the company's investment in emission reduction.

Although the HKEX will implement the New Requirements for climate disclosure within its ESG Reporting Guide next year, Greenpeace has reviewed and compared them with other jurisdictions and reveals three major shortcomings that may fail to address the current inconsistencies in disclosure mentioned above. First, the new Requirements allow companies to decide whether to disclose data on the most significant carbon emissions categories, which included the 15 categories covering upstream and downstream activities. Unlike Europe's mandatory "comply or explain" approach for all 15 categories, this may allow companies to conceal, selectively disclose, or underreport emissions. Given the current disclosure landscape, the HKEX's New Requirements may lead to ongoing incomplete disclosures if they continue to depend on the voluntary selection of emission categories.

Furthermore, independent third-party assurance may enhance the credibility of climate data and reduce the risk of “underreporting.” The report found that among the 63 companies that disclosed Scope 3 data, 32% (20 companies) hadn't undergone any third-party assurance. Of the 42 companies that did pursue assurance, only 38% (16 companies) opted for the more comprehensive "reasonable assurance." However, the HKEX New Requirements only "encourage" rather than "mandate" third-party assurance, allowing companies to opt for "limited assurance" or even forgo assurance entirely. In contrast, both New Zealand and the European Union already mandated listed companies to undergo at least "limited assurance," with the EU transitioning to "reasonable assurance" by 2028.

The report further highlights that the new HKEX regulations do not include specific penalties for underreporting or omitting climate information. Instead, they rely on general disclosure obligations outlined in the Listing Rules, such as public censure, suspension, or delisting. However, these measures are generic and not tailored to climate or ESG disclosures, lacking explicit fines or sanctions. This deficiency could potentially undermine the effectiveness of the New Requirements, making them appear ineffective or "toothless." In contrast, France imposes specific penalties for non-disclosure of climate information or impeding audits, including fines and even imprisonment, with the maximum penalty amounting to €75,000 and a potential imprisonment term of up to five years.

Greenpeace has highlighted that despite the government's assertion that Hong Kong is progressing towards becoming an international green finance hub, the quality of climate-related disclosures among listed companies and the deficiencies in HKEX's new carbon emissions disclosure standards fall behind those of several other jurisdictions. Greenpeace suggests that HKEX should enforce complete disclosure of all 15 Scope 3 emission categories, mandate third-party assurance for reported emissions data to boost credibility, and enhance liability/penalties for non-compliance with greenhouse gas disclosure regulations to bolster the effectiveness of the new requirements.

Full Report: https://tinyurl.com/5n6vjpyr

1The report analyzes the emissions disclosure of the three scope areas of the sample companies on a comparative basis, selecting the categories with the larger market share and using the real estate and financial services sectors as an example, with reference to similar data from the Carbon Disclosure Project (CDP).

2According to the CDP data, for this sector, Category 2 : Capital Goods, was generally the most dominant emission category, accounting for 48.7% of the total.

3According to the CDP data, Category 15: Investment, was generally the most dominant emission category, accounting for 99.8% of the total.

Appendix 1: Detailed list of Scope 1, 2, 3, and the 15 categories

Appendix 2: Comparison of Regulations in Different Jurisdictions

Media Contact

| Tom Ng Greenpeace Campaigner Email: [email protected] Tel: 2854 8363 |

Naima Leung Greenpeace Communications Officer Email: [email protected] Tel: 2854 8306 |