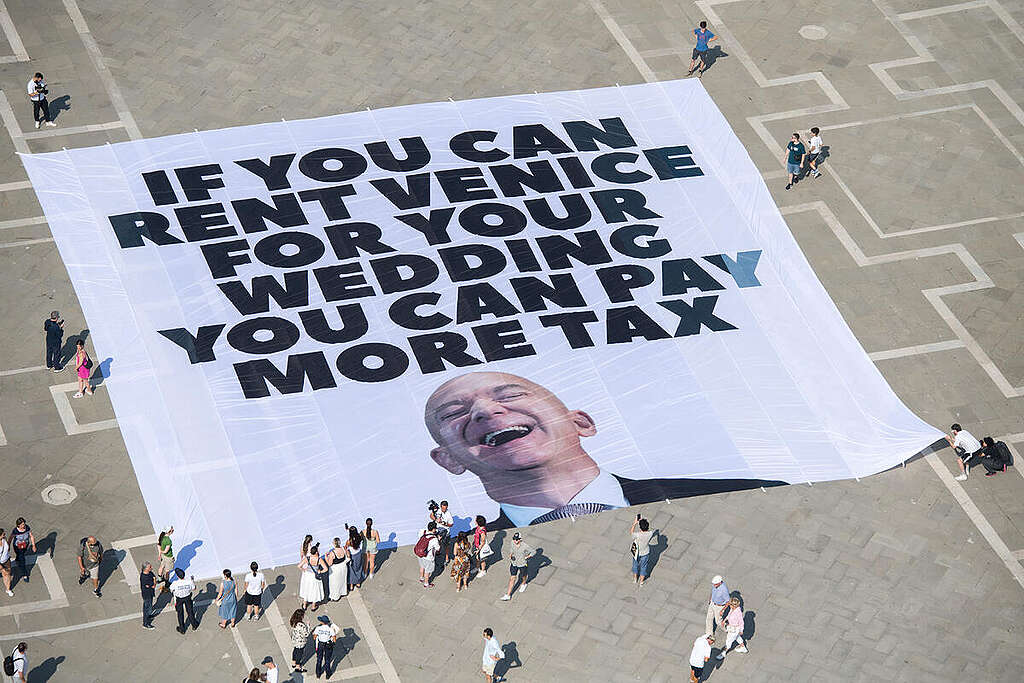

On June 23rd, together with “Everyone Hates Elon”, we took over Venice’s Piazza San Marco with a giant 20-metre banner of billionaire Jeff Bezos ahead of his wedding celebrations this week, which he is reportedly celebrating on a megayacht, off the coast of Venice – a city literally sinking under the climate crisis.

According to reports, the lavish wedding celebration is expected to cost up to $11 million, complete with yacht excursions and $500,000-a-night luxury villas. The wedding will also reportedly be attended by Hollywood elites and billionaires alike.

While they pop champagne, the rest of the world is reminded of just how distant and disconnected the lives of the super-rich are from ours.

But here’s the thing: this isn’t just about extravagance, showoff or envy. It’s about power, democracy, safety, and, most importantly, equality. A crucial step towards social, climate and environmental justice is to tax billionaires fairly.

Taxing extreme wealth could help tackle the climate and nature crisis, not to mention lift nations out of poverty and fund schools and hospitals. It could shift power away from billionaires and back to the people. It’s about changing the existing unjust system so that no one can hoard that much wealth in the first place.

The 4th International Conference on Finance for Development (FfD4), taking place from June 30 to July 3 in Seville, Spain, is a once-in-a-decade moment to change the system. It can help reshape the global financial system to shift power away from the very few towards a new model that delivers justice for people and the planet.

Taxing extreme wealth is one of the priorities of our time

Jeff Bezos is throwing this extravagant wedding while 44% of the world’s population survives on less than $6.85 a day. How is this fair?

While Jeff Bezos sails a megayacht estimated to cost $500 million, extreme weather displaced 824,000 people in 2024 (according to Earth.org) – that’s more than any year since 2008. Billionaires like Bezos spend a massive amount on extravagant luxuries the planet can’t afford and continue to see their fortunes soar thanks to tax loopholes, political influence, and the exploitation of people and the planet.

Meanwhile, the rest of us live in a moment of multiple crises: climate and environmental breakdown, rampant inequality, failing healthcare and education systems. In 2024 alone, the most costly climate disasters reportedly killed 2,000 people and caused $229 billion in damages. This is in addition to families going hungry, underpaid essential workers and a growing public distrust in governments.

Who exactly are the “super-rich”?

When we talk about taxing the super-rich, we’re not talking about ordinary hard-working business owners, the high-earning middle class, or even your neighbour who owns the latest Range Rover. What we are talking about are billionaires whose wealth has been stashed in tax havens, and whose polluting lifestyles are contributing more than the rest of us to our burning planet, while public services are crumbling as a result of austerity measures.

(For context: If your salary were $100,000 per annum, with no tax or spending, it would take you 10 years to become a millionaire, but 10,000 years to become a billionaire!)

What could a tax on the super-rich actually fund?

Jeff Bezos is worth more than the GDP of entire countries – yet he pays (in relative terms) far less taxes on his net worth than teachers, nurses, or street vendors hustling to make a living selling fruit, snacks, or goods on the side of the road. A modest wealth tax, following the footsteps of Spain, on the richest individuals could generate trillions of dollars. The money to make sure everyone can live a decent life exists. What’s missing is the political will to act.

By taxing the super-rich, governments could

- Invest in sustainable, affordable and efficient energy and transportation, and all those climate solutions governments say we can’t afford.

- Fund universal basic services such as quality healthcare, affordable housing, education, water and sanitation

- Provide social protection for the most vulnerable

Billionaires are not wealth creators. They are wealth extractors. And with each passing day, you and I, the living world and future generations pay the price for as long as they are not taxed fairly.

Is it utopian? No – the tide is turning

From the UN to national parliaments, from economists to public opinion polls, the idea of taxing the super-rich is gaining serious traction. Even millionaires themselves (Patriotic Millionaires UK – PMUK) are asking to be taxed more.

Crucially, we have the United Nations Tax Convention that is being negotiated right now until 2027. This is a game changer for global tax rules that will allow all UN nations (and not just a few rich OECD countries) to shape and determine the future of taxation so that it is fair for all.

It’s not just about headlines. Yes, it’s tempting to roll our eyes at Bezos’ wedding and the outrageous extravagance of it all. But we must go deeper. The point isn’t to pick on billionaires as individuals – it’s to question and dismantle a system that allows a tiny few to amass unimaginable wealth and power while so many go without.

We deserve a world where the wealth generated by our shared work, created by people, serves people. History is watching. The future is watching. And one day, we will look back at this moment and ask: Did we stand up against billionaires? Did we fight back against the system?

CLAIM YOUR POWER

Make the polluting super-rich pay their fair share in taxes!

So next time someone asks, “Why do you care what billionaires are doing?” you can send them this blog!

Amrita Ranjit

Global Digital Engagement Specialist, Fair Share