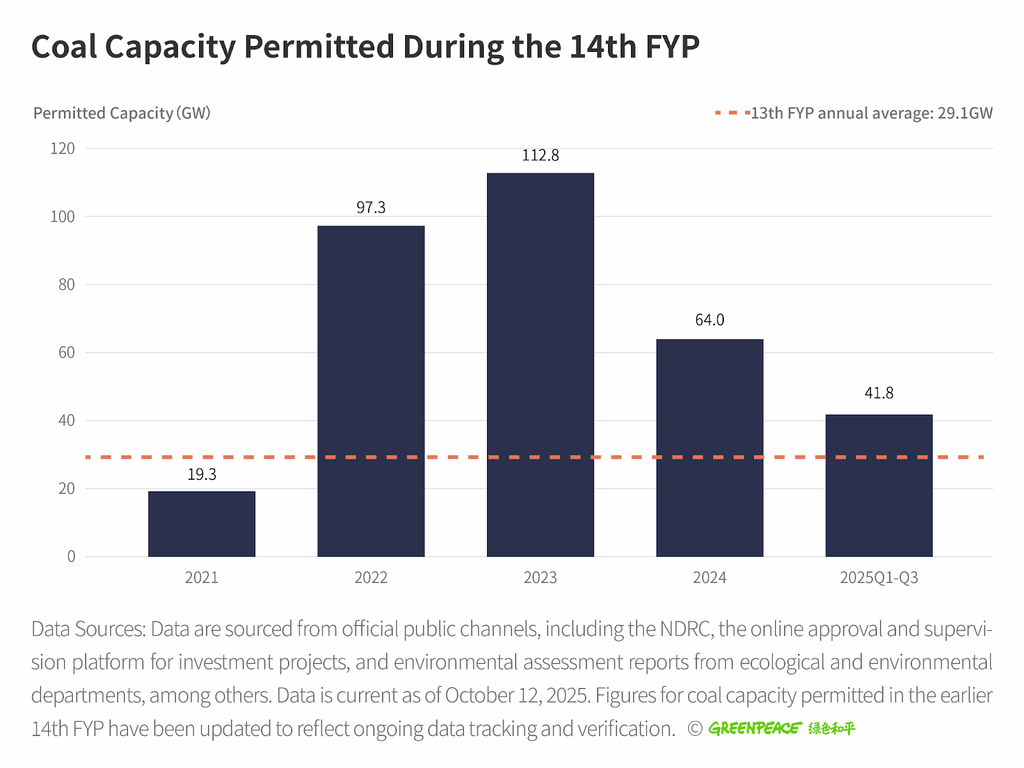

Beijing — New research from Greenpeace East Asia shows that China approved 41.77 gigawatts (GW) of new coal power capacity nationwide in the first three quarters of 2025, and if the current pace continues, 2025 is on track to be the second-lowest year for approvals in the 2021–2025 period and would mark a second consecutive year of decline.

Greenpeace East Asia Beijing-based climate & energy project manager Gao Yuhe (she/her) said:

“China’s power-sector emissions peak is within reach as early as 2025. Yet, maintaining momentum to curb coal approvals remains critical: 41.77 GW approved in nine months alone still threatens this trajectory. Clear policy signals to cap coal and boost renewables are essential to accelerate both the power sector and societal emissions peaks.”

Coal Capacity Permitted During the 14th FYP1 (2021-2025)

Greenpeace East Asia reviewed official documents, including project approvals and environmental impact assessments, to track new coal approvals in China by the end of Q3 2025.

With the 41.77 GW additions in Q1-Q3 2025, total coal capacity approved from 2021 to Q3 2025 now stands at 340 GW—more than twice the total permitted in the last five-year period. Among them, non-CHP (combined heat and power) coal projects have fallen sharply—from 40–50 permits per year at the 2022–2023 peak, to 23 in 2024, and 16 in Q1-Q3 2025—while CHP project counts have stayed relatively stable annually. However, large-scale units (≥660 MW) still dominate, accounting for over 90% of newly permitted units.

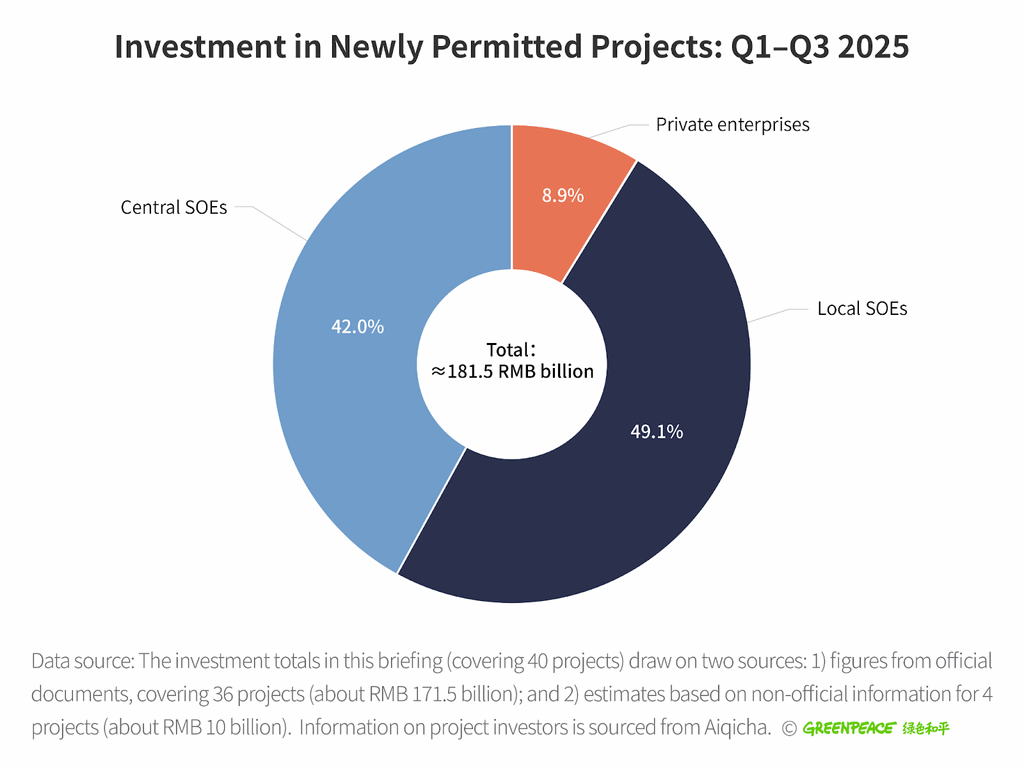

Our research further indicates that the total investment in coal projects permitted in Q1-Q3 2025 is estimated at RMB 171.5–181.5 billion,2 with a state-capital–heavy structure: central SOEs and local SOEs account for roughly 40% and 45%, respectively, while private investment remains below 10%.

Investment in Newly Permitted Projects: Q1–Q3 2025

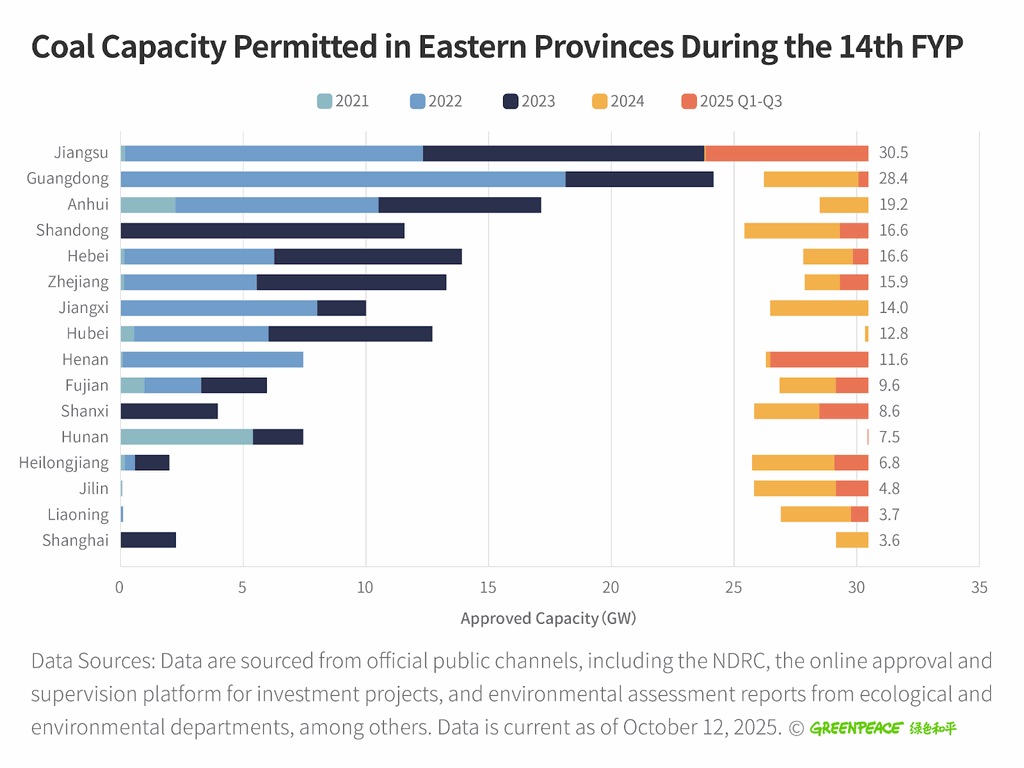

Geographically, in eastern China, Jiangsu (6.64 GW) and Henan (4.02 GW) rebounded after low 2024 volumes, ranking first and third nationwide for permitted capacity in Q1–Q3 2025. By contrast, other major power-demand and generation provinces—Shandong (1.16 GW), Guangdong (0.42 GW), Anhui (0 GW)—have continued to decline from their 2023 peaks.

Coal Capacity Permitted in Eastern Provinces During the 14th FYP

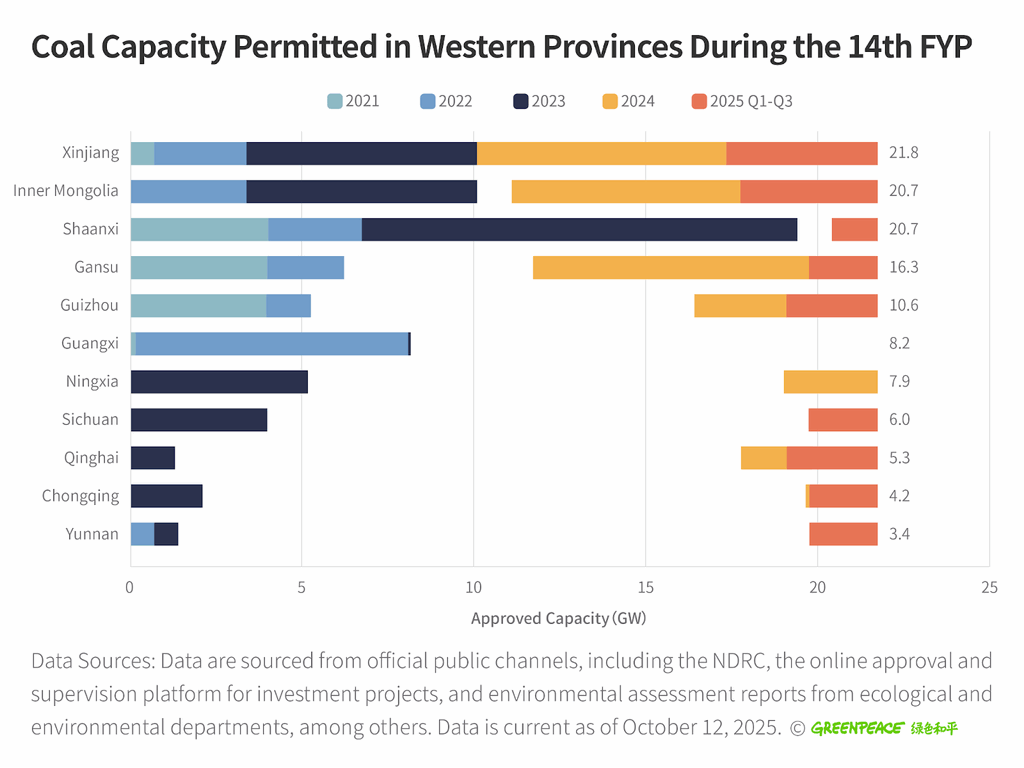

Since 2024, permitting has shifted west. The western provinces’ share of nationwide permits rose from roughly one-third in 2021–2023 to 48% in 2024, and to more than 50% in Q1–Q3 2025. From 2024 through Q3 2025, the top three provinces by permitted capacity were Xinjiang (11.65 GW), Inner Mongolia (10.64 GW), and Gansu (10.02 GW). Guizhou (2.64GW), Sichuan (2GW), and Chongqing (2GW) posted their highest 14th FYP levels in Q1–Q3 2025.

Coal Capacity Permitted in Western Provinces During the 14th FYP

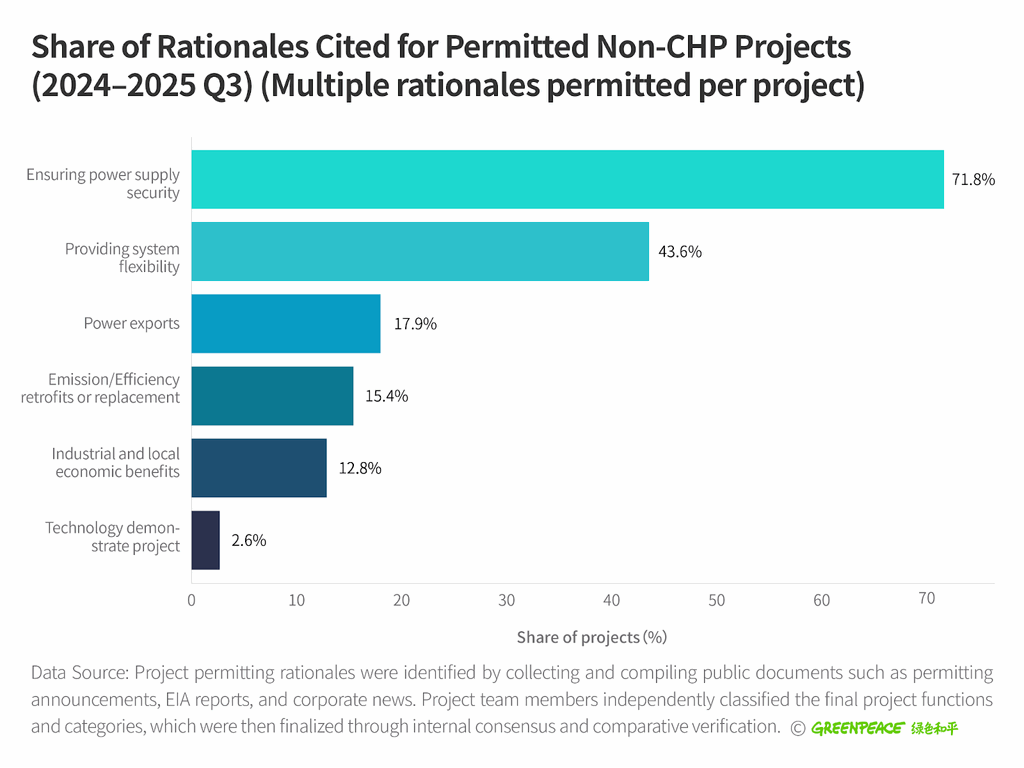

Furthermore, Greenpeace East Asia’s review of 39 non-CHP projects permitted in 2024–2025 finds that “ensuring power supply security” remains the primary rationale, cited in over 70% of cases. “Providing system flexibility” ranks second, cited in more than 40% of projects. Over half of these projects cite multiple rationales. Of the 17 projects explicitly citing “providing system flexibility,” 15 (nearly 90%) also cite “ensuring power supply security,” indicating a hybrid functional positioning.

Share of Construction Rationales Cited for Permitted Non-CHP Projects (2024–Q3 2025) (Multiple rationales permitted per project)

Gao said:

“The rationale for new coal power is increasingly framed around ‘power supply security’ and ‘system flexibility,’ yet these new coal plants risk becoming stranded assets in a rapidly decarbonizing power system. Local governments must not rely on coal as the default means of ensuring energy security. Repositioning coal as a genuinely flexible support resource—not a baseload provider—is critical to the further development of the renewable-dominant New Power System.”

In terms of renewables development, our research finds that the 2021–2025 period has seen unprecedented growth. By September 2025, China’s installed power capacity reached 3,720 GW, with renewables accounting for 59.1 %.3 In early 2025, combined wind and solar capacity surpassed coal for the first time, marking a new phase in China’s power-system transition.

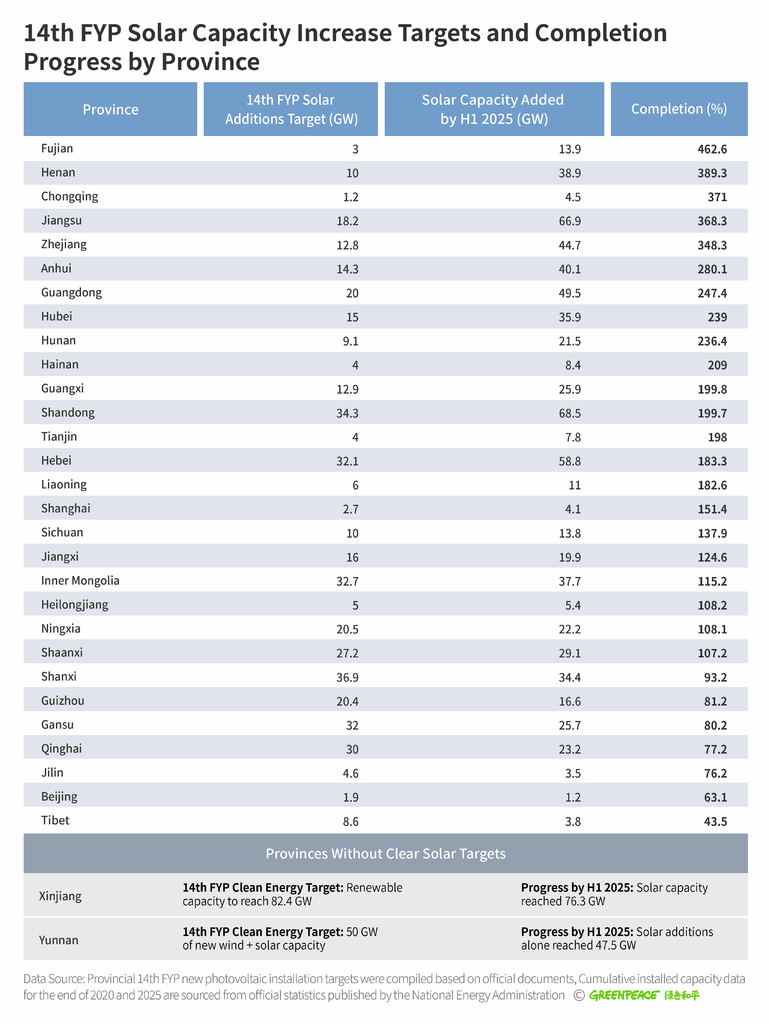

14th FYP Solar Capacity Increase Targets and Completion Progress by Province

Solar build-out has run well ahead of most provinces’ 14th FYP targets in the 2021–2025 period. 29 of the 31 provinces set explicit PV goals; by H1 2025, 22 had already met or exceeded them.4 Henan, Chongqing, Jiangsu, and Zhejiang surpassed 300% of their planned capacity, and Fujian exceeded 400%.

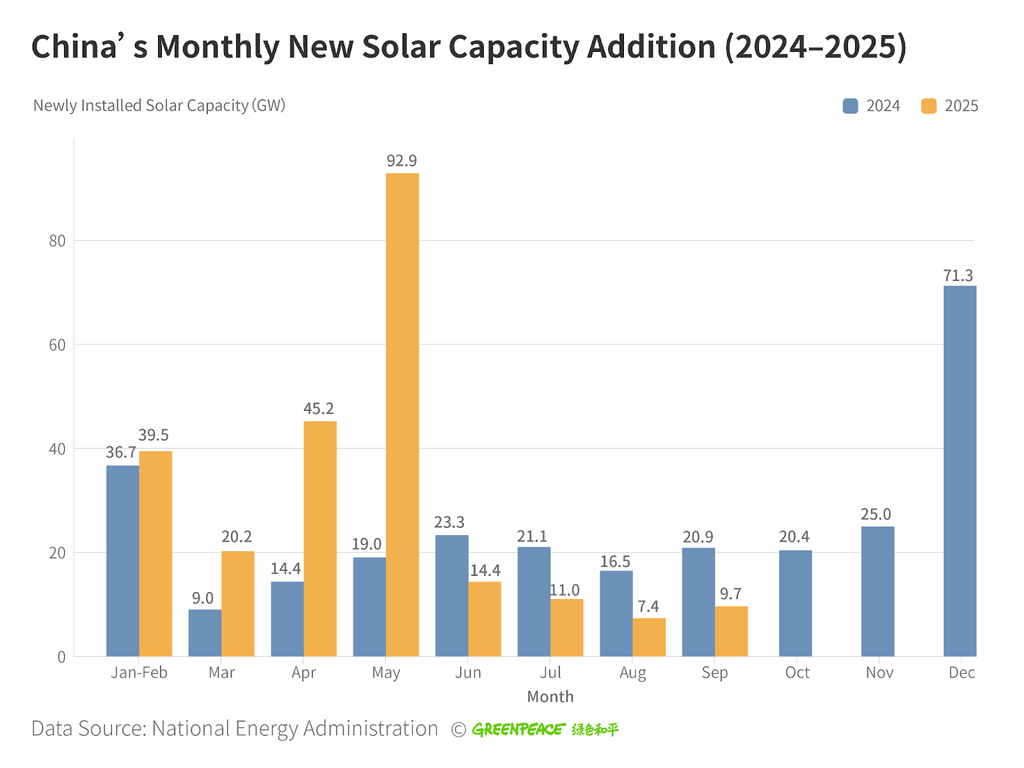

China’s Monthly New Solar Capacity Addition (2024–2025)

Gao said:

“With the rapid expansion of renewables, China’s power sector can peak carbon emissions as early as 2025. However, the recent sharp drop in solar additions and continued growth in coal capacity create structural headwinds. Sustained, high-speed renewable deployment alongside truly clean flexible resources is critical to keep China’s decarbonization pathway on track and ensure energy security without relying on more polluting coal.”

To secure a low-carbon, reliable, and cost-effective power system during China’s next five-year plan period, Greenpeace East Asia urges the country’s policymakers to:

- Issue a top-level framework for power-sector transformation over the next five years by setting forward-looking targets to accelerate clean-power substitution for coal and raising 2030 wind, solar, and energy storage targets, along with associated investment intensity.

- Integrate coal planning into a unified system alongside wind, solar, and energy storage, update risk warning and planning mechanisms with a timetable to cap coal generation, and require provinces and SOEs to assess potential stranded-asset and economic risks for new coal projects.

- Shift provincial energy strategies toward renewables and flexible resources by scaling up investment, prioritizing distributed renewables, advanced energy storage, and demand response, to increase the share of wind and solar and enable the structural substitution of existing coal capacity.

- Promote energy storage deployment and strengthen market mechanisms by finalizing capacity-based tariff rules, enabling storage participation in energy and ancillary service markets, deploying storage at scale, and enhancing operational coordination between storage and renewables.

NOTES

- FYP stands for Five-Year Plan. It is a series of social and economic development initiatives in China. Each FYP outlines the central government’s priorities, national goals, and key policy directions for the ensuing five-year period. For example, the 14th FYP covers the years 2021 through 2025 and the 15th FYP covers the years 2026 through 2030.

- For the 40 projects permitted in 2025, Greenpeace East Asia compiled the total investment figure based on publicly available information. Data for 36 projects (about RMB 171.5 billion in total investment) come from official documents such as approval notices, environmental impact assessment reports, and corporate disclosures. Investment figures for the remaining 4 projects (about RMB 10 billion) are estimates derived from non-official sources.

- National Energy Administration. (2025, April 25). 我国风光装机历史性超过火电 风电光伏装机超过火电将成为常态 [China’s wind and solar installed capacity surpasses coal for the first time; wind and PV surpassing coal to become the new normal]. https://www.nea.gov.cn/20250425/148efd0ca61148148d285edd438912df/c.html.

- Data compiled by Greenpeace East Asia based on provincial-level official documents and other publicly available information. Sources include, but are not limited to, provincial 14th FYP, new energy special plans, and carbon peak action plans.

END

To read the full briefing (in English) click here.

To read the full briefing (in Chinese) click here.

For media enquiries please contact:

Greenpeace East Asia, Beijing, [email protected]

Greenpeace International Press Desk, [email protected], +31 20 718 2470 (24 hours)