SEOUL – As the Indonesia International Motor Show (IIMS) kicks off, a new research briefing from Greenpeace East Asia highlights that automotive giant Hyundai-Kia is swiftly losing its foothold in one of the world’s fastest-growing electric vehicle markets.

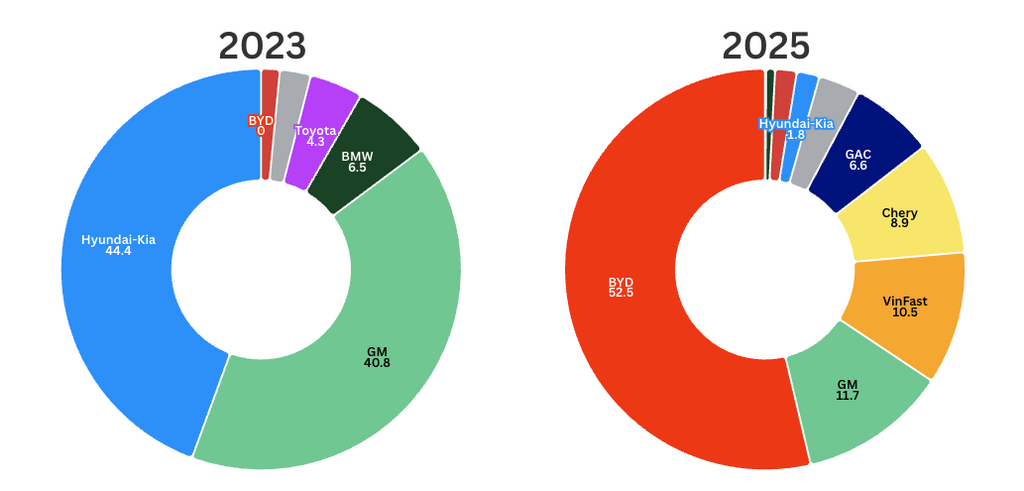

Despite entering the market early, Hyundai-Kia’s battery electric vehicle (BEV) sales in Indonesia plummeted by an astonishing 75.9% from 7,590 units in 2023 to 1,828 units in 2025, marking the sharpest decline in BEV sales among major automakers in the Southeast Asian country (Figure 1). In stark contrast, the overall Indonesian BEV market experienced sixfold growth during the same period, driven by intense competition from BEV-focused brands like BYD and VinFast.

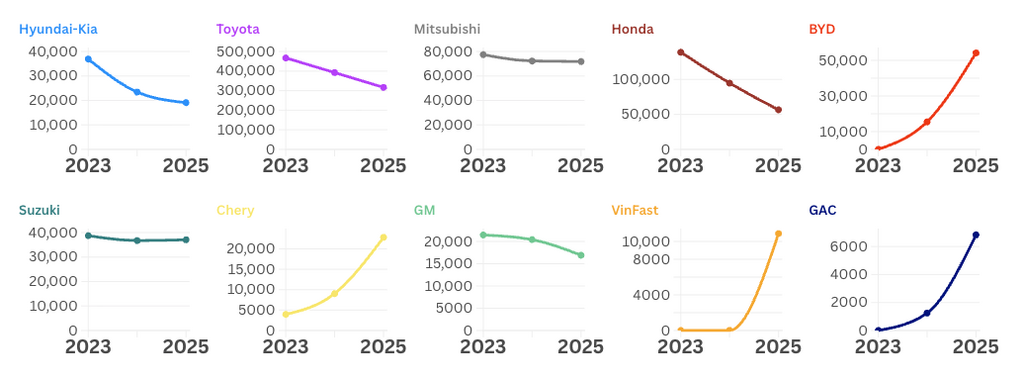

This downturn has significantly impacted Hyundai’s overall vehicle sales, placing the company among the top three automakers—alongside Japan’s Toyota and Honda—that saw the biggest drops in total sales in Indonesia from 2023 to 2025 (Figure 2).

Eunseo Choi, Climate and Energy Campaigner at Greenpeace East Asia, said:

“As Indonesia captures the attention of global automakers with its burgeoning EV market and favorable policies for local production and battery supply chains, Hyundai’s recent retreat serves as a stark warning against complacency in a swiftly evolving landscape. Between 2023 and 2024, Hyundai’s BEV sales plummeted by nearly two-thirds, while BYD skyrocketed to market leadership in electric vehicle sales from a standing start. This stark contrast underscores the dangers of relying on internal combustion engine vehicles—a mistake already evident among some Japanese automakers—risking rapid erosion of competitiveness.”

Figure 1. Market shares of battery electric vehicles in Indonesia by automakers from 2023 to 2025 (%)

Figure 2. Overall vehicle sales in Indonesia by automaker from 2023 to 2025 (Top 10 automakers ranked by new vehicle sales in 2025, except for Hyundai-Kia)

Key findings:

– Indonesia’s BEV sector has experienced an exponential 20,000-fold increase in sales since 2020, rising from just 5 units to over 103,000 by 2025, making it Southeast Asia’s third-largest BEV market. In 2025 alone, BEV sales surged by nearly 140%, while traditional internal combustion engine (ICE) vehicle sales fell by nearly 20%.

– Hyundai-Kia’s overall sales in Indonesia fell by 48.2% from 2023 to 2025, dropping from 36,875 to 19,088 units. In the BEV segment, sales plummeted by 75.9%, falling from 7,590 units in 2023 to just 1,828 in 2025, marking the largest decline in BEV sales among automakers in the country. Once a leading BEV seller in 2023, Hyundai-Kia has now dropped to seventh place in market share by 2025.

– BEV-focused automakers, especially BYD, are quickly gaining ground in the Indonesian market. In its first year entering Indonesia, BYD became the country’s top BEV brand, selling over 15,000 vehicles and capturing 35.7% of the market in 2024. By 2025, sales soared to 54,185 units, giving BYD a 52.5% market share and making it the fourth largest automaker in overall vehicle sales. Other BEV brands like Chery, VinFast, and GAC also saw significant sales growth and surpassed traditional leaders like Hyundai-Kia and BMW to become Indonesia’s top 10 automakers in vehicles sold.

– Hyundai-Kia hasn’t announced any phase-out targets for BEVs or ICE vehicles in Indonesia and Southeast Asia, even though it has set clear goals for Europe and the United States. This lack of commitment puts the company’s aim of achieving global carbon neutrality by 2045 at risk.

“The clock is ticking for legacy automakers in Indonesia, the world’s fourth most populous country and a crucial battleground in the climate crisis. Hyundai-Kia has the right infrastructure with its Karawang plant and local battery production, but its hesitation to shift away from fossil fuels is turning into a costly mistake. To remain relevant and uphold its global climate commitments, the company must act swiftly and transition to a fully electric lineup in Southeast Asia, prioritizing the introduction of energy-efficient BEVs while ensuring the responsible management of key materials like nickel. Hyundai must align its carbon neutrality goals for 2045 with actionable commitments to electrification and environmental responsibility. In such a rapidly evolving market, waiting isn’t just a business risk—it’s a failure to address the climate challenge,” said Choi.

Greenpeace East Asia urges Hyundai-Kia to:

- Announce a clear, time-bound phase-out target for all ICE vehicles in Southeast Asia

- Shift local production focus from ICE-heavy lineups to affordable BEV models.

- Align regional marketing and sales strategies with the Paris Agreement’s 1.5°C goal.

- Promote decarbonization and ensure the responsible, transparent sourcing of critical materials such as nickel.

END

Notes:

[1] Vehicle sales data for this brief were sourced from MarkLines, the Automotive Industry Portal, accessed in January 2026.

Media Contact:

Yujie Xue, International Communications Officer, Greenpeace East Asia, +852 5127 3416, [email protected]