Greenpeace has done the math and worked out that there’s a USD205 billion opportunity for renewables in SE Asia over the next 10 years. With recent climate pledges from the three big East Asian nations — China, Japan and Korea — to go carbon neutral in the next 40 to 50 years, should be just the incentive for public development banks (PDBs) in the region to start investing big in clean energy.

What are banks investing in?

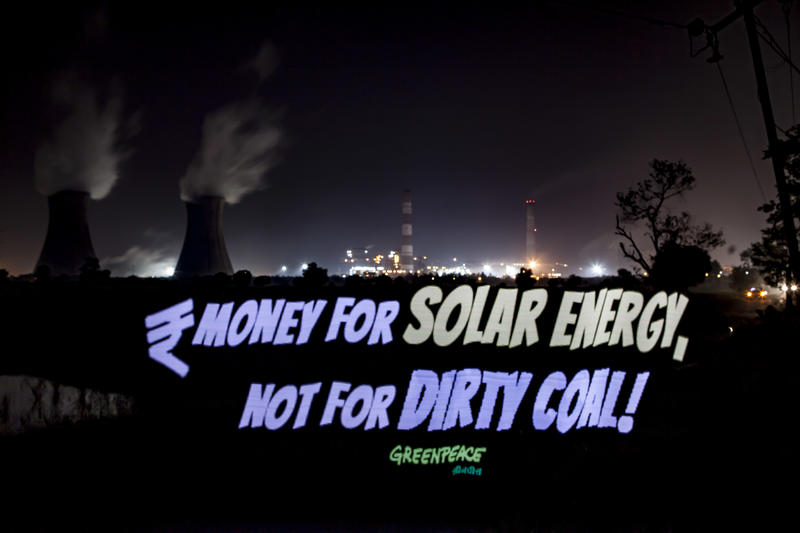

The governments of China, Japan and Korea have made ground-breaking net zero commitments but haven’t yet confirmed that these will apply to their overseas investments. This is a double standard, allowing fossil fuel funding overseas, while renewable energy (RE) is promoted at home.

What we need is state-backed PDBs to align themselves with their countries’ net zero carbon pledges and focus their overseas investments into helping SE Asia transition to RE now. We need them to show the same ingenuity they put into coal and use that for clean energy.

Because, despite coal being universally viewed as a bad and risky investment, PDBs are still putting their money in coal.

For example, Japan[1] and Korea[2] are exporting nitrogen dioxide and PM2.5 pollution by funding coal-fired power plants that would not even pass standards at home even though they could so easily be a champion for renewables. These plants could cause premature deaths numbering in the hundreds of thousands in Southeast and South Asia.

China[3] is a big investor in renewables but also primarily in coal. Since 2014, the country has funded 12,622 MW of wind and solar along the Belt and Road – a huge increase. But it has also funded 67.9GW to coal (six times more), the vast majority in South and SE Asia.

Change is happening

All over the world from the US to UK, Mexico to Malaysia, the trend is to dump coal. Over 100 big banks and insurers[4] are divesting out of coal and/or coal-fired power plants. This is freeing up significant amounts of money, but what we must ensure is that they are putting this into renewables rather than other fossil fuels such as gas. For this to happen we need policies to make it easier and to create incentives for people and institutions to invest in renewables.

Recipient countries are cancelling coal too. Just in November, the Philippines[5] declared a moratorium on new coal-fired power plants, although those already approved will still be built. In December, Pakistan[6] said it would stop all new coal plants and that by 2030 it aimed to generate 60% of its energy through renewable sources. There are also some encouraging signs from Vietnam[7]: Hanoi has laid out a plan to start in 2021 to cut back on coal and boost investment in RE, although it hasn’t yet provided details of how and how much coal will be controlled.

What are the opportunities in SE Asia?

SE Asia is on a fast development track and the current energy mix is heavily slanted to coal and gas. If they don’t start the transition now, it could spell disaster for the climate. The region is also one of the most vulnerable for climate impacts including coastal flooding and other extreme weather events that cost people’s lives. Now is the time for them to change, and they can do it with backing from East Asian banks.

For banks in East Asia that have long-held deep ties in SE Asia, it makes absolute financial sense to invest in RE in the region. A report from Greenpeace Japan[8] found that there is a USD $205 billion opportunity for RE finance in SE Asia in the next ten years, that’s 2.6 times bigger than the coal market of the past decade.

One example of what incentives can do is what’s been happening to the solar photovoltaic (PV) market in Vietnam.[9] Progressive policy change there has made Vietnam into the country with the largest installed PV capacity in the region with a more than 40% share, leaping from 134 MG in 2018 to around 5.5 GW in 2019. A key factor behind this was the use of a feed-in-tariff (FIT) programme making solar PV attractive financially.

What should banks be doing?

East Asian finance must get creative and get behind RE. They need to be pioneers. They had mechanisms in place for coal financing now they need to be just as creative with clean energy.

Greenpeace campaign progress

Greenpeace’s environmental work on green finance has made solid progress with private banks in the region. The major breakthrough in 2020 was getting Japan’s three biggest banks[10] to pledge to stop funding new coal power plants. We did the same in Korea, where banking group KBFG[11] said it will no longer fund nor invest in coal power projects at home and abroad.

In the Philippines, just three weeks after we published our Southeast Asia Power Sector Scorecard[12] in September, the government announced its moratorium on new coal plants.

Where the money goes has a deciding influence on how well we will be able stop the climate crisis in the years to come. Greenpeace will keep lobbying, campaigning and pushing for banks to seize this opportunity. And that’s where you come in. Keep following our work, support us when and where you can, and let’s march forward into a green-powered future together.

[1] https://www.greenpeace.org/international/press-release/23848/japan-funds-toxic-coal-plants-abroad-emitting-more-pollution-than-domestic-plants-greenpeace-analysis/

[2] https://www.greenpeace.org/international/press-release/27249/south-korean-financed-coal-plants-predicted-to-cause-up-to-151000-deaths/

[3] https://www.greenpeace.org/international/press-release/23446/chinese-equity-investments-in-energy-reshape-south-and-southeast-asia-greenpeace-analysis/

[4] https://ieefa.org/finance-exiting-coal/

[5] https://news.mongabay.com/2020/11/philippines-declares-no-new-coal-plants-but-lets-approved-projects-through/

[6] https://www.voanews.com/south-central-asia/pakistan-decides-against-new-coal-fired-power

[7] https://www.argusmedia.com/en/news/2129998-vietnam-prepares-to-rein-in-coalpower-growth

[8] https://www.greenpeace.org/static/planet4-japan-stateless/3d3693f8-1.-g3-re-finance-report-full.pdf

[9] https://www.woodmac.com/press-releases/vietnam-becomes-southeast-asias-hottest-solar-pv-market/

[10] https://www.greenpeace.org/eastasia/blog/6219/china-japan-and-korea-promised-carbon-neutrality-now-we-need-them-to-make-it-happen/

[11] https://www.kedglobal.com/newsView/ked202010100018

[12] https://www.greenpeace.org/southeastasia/publication/44037/southeast-asia-power-sector-scorecard-assessing-the-progress-of-national-energy-transitions-against-a-1-5-degrees-pathway/