In case you haven’t heard, Canada’s big banks are bankrolling the climate crisis. The Big Five banks (RBC, TD, Scotiabank, BMO and CIBC) have collectively poured over $900 billion into fossil fuels since the Paris Agreement was adopted in 2015, and they are showing no signs of stopping.

Because of this huge financial support, the fossil fuel industry is able to continue producing the massive quantities of oil, gas and coal that are causing the climate crisis, and the climate crisis keeps getting worse. Until we phase out fossil fuels, and fossil fuel financing, deadly and devastating climate disasters like last year’s floods and wildfires in B.C. will keep happening and keep getting worse.

Canada does have a banking regulator, OSFI, which could and should step in to protect the public from the banks’ reckless and destructive overfinancing of the fossil fuel sector. But so far they have failed to act and stop the banks from playing the role of planetary arsonists.

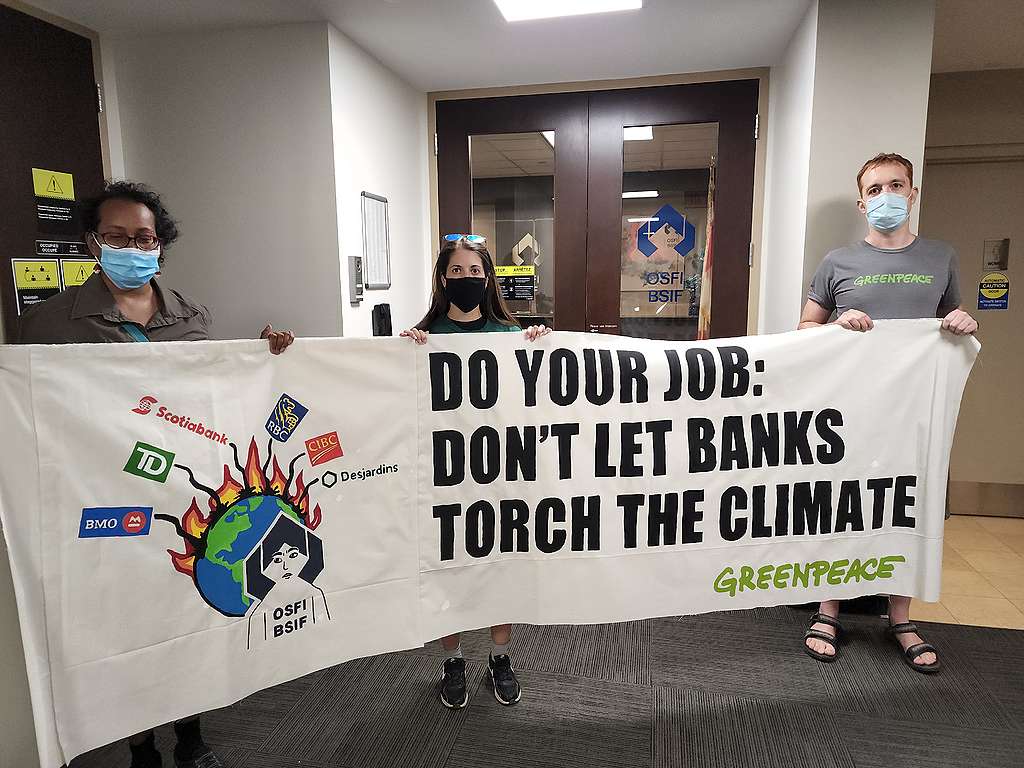

That’s why this week Greenpeace activists paid a visit to OSFI’s offices in Toronto and delivered a message: Don’t let banks torch the climate!

The activists delivered the charred and broken remains of a teacup recovered from the community of Lytton, B.C. after it was destroyed by climate-fueled wildfires in 2021. The hope is that Peter Routledge, the head of OSFI, or other OSFI staff, will keep this memento in their office as a reminder of their responsibilities to the public and the terrible harms caused by the burning and financing of fossil fuels. And that this will help move them to act.

As it happens, OSFI did recently put forward a set of draft climate guidelines for the banks. But the guidelines are seriously inadequate. For one thing, they’re guidelines—when what we really need are binding rules to force the banks to stop financing fossil fuels. For another, while the guidelines do call for climate plans from the banks, there’s no requirement for these climate plans to be 1.5˚C-aligned, or for the banks to take any specific steps to reduce their financing of fossil fuel pollution. There are other problems with the guidelines, but these shortcomings illustrate the overarching failure of the bank regulators to step in and force the financial sector to stop financing the climate crisis.

What should OSFI do instead? Force banks to phase out their financing of fossil fuels at the pace needed to keep warming below 1.5˚C, and help ensure bank financing activities are aligned with respect for Indigenous rights.

How should they do this? Key things Greenpeace would like to see from OSFI’s climate rules for banks are: a requirement to submit 1.5˚C-aligned plans, with interim 5-year targets and penalties for non-compliance; strong, mandatory TCFD-aligned climate risk disclosures, including publicly-available 1.5˚C stress tests; increased capital requirements for lending to fossil fuels and other high carbon activities; and explicit credit guidance policies to ensure bank financing activities are supporting the transition and 1.5˚C-aligned. More details on what Greenpeace would like to see from OSFI are outlined in our 2021 submission to OSFI’s climate consultation process.

OSFI wants to know what the public thinks about their draft climate guidelines, and the public comment period is open until September 30, 2022.

This is a great opportunity for all of us who are concerned about the toxic partnership between big banks and the fossil fuel industry to make our voices heard. It’s as simple as emailing [email protected] and letting them know what you think (and please cc us on your message at [email protected]!).

If you want some ideas of what to say, we’ve drafted an example submission below that you can use for inspiration or simply submit your comment using the same text.

Sample Message:

Dear OSFI,

Thank you for the opportunity to comment on Draft Guideline B-15 Climate Risk Management.

I’m extremely concerned about the devastating impacts of the climate crisis and the role of the financial system in financing fossil fuels and other activities causing the crisis. All levels of government should be responding with the speed and urgency the crisis demands to get emissions down to zero as quickly as possible.

While I’m happy to see OSFI starting to incorporate climate change into its regulatory approach, I’m deeply concerned that the draft guidelines fall far short of what’s needed to protect the Canadian financial system and the Canadian public from climate risks.

Some of the biggest problems with the guidelines are:

- They are guidelines rather than binding rules

- The Climate Transition Plans that banks are required to submit do not have to be 1.5˚C-aligned or meet any specific requirements around reducing financed emissions

- It’s not clearly stated that scenario analyses have to be publicly reported or that they must include a 1.5˚C scenario

- There’s no mention of the connections between climate change and Indigenous rights, or banks’ responsibilities to respect Indigenous rights

I would like OSFI to force banks to phase out their fossil fuel financing and reduce their financed emissions in line with keeping warming below 1.5˚C. OSFI should:

- Put forward binding climate rules rather than just guidelines

- Require financial institutions to submit 1.5˚C-aligned climate plans with interim 5-year targets and penalties for non-compliance

- Require strong, mandatory TCFD-aligned climate risk disclosures, including publicly-available 1.5˚C stress tests

- Increase capital requirements for lending to fossil fuels and other high carbon activities

- Bring in explicit credit guidance policies as needed to align the financial sector with the fight against climate change

- Take steps to ensure bank financing activities are aligned with respect for Indigenous rights

Thank you for your time.

Sincerely,

[your signature]

Discussion

Phase out fossil fuels and stop letting banks support the climate crisis.

It's foolish to keep investing in fossil "fool" projects when renewable energy projects are cheaper, don't pollute, and are sustainable!

OSFI, do your job & make banks et al ethical by stopping them from overspending on on fossil fuel corps. which contribute to more rapid environmental warming.

Where is the money to support climate change measures? That would be cheaper than paying for these increasing menacing disasters! Step up Trudeau--Ford--Premiers. Do something!

Phase out fossil fuels and stop letting banks support the climate crisis.

The focus should be sustainability, eco-friendly, renewable energy and resources. We are all living in a toxic climate crisis, we need to phase out fossil fuels and STOP letting banks support the climate crisis, fracking, and destroying entire ecosystems. By doing so droughts, floods, fires, severe tsunami's, hurricanes, and tornados accelerate, they are becoming more severe and damaging every year.

We’re these guidelines drafted by the fossil fuel industry???

DO NOT LET BANKS CONTROL US! WE DO NOT WANT FOSSIL FUELS!!!!!!!!