LNG Projects Awaiting Final Investment Decision Do Not Stand Up to the United States Government’s Official Analysis

In a new report, Greenpeace USA, Earthworks, and Oil Change International analysed five major planned US liquefied gas export facilities through the lens of the Climate Test benchmark derived from the US Department of Energy’s 2024 LNG Export Study.

The five US liquefied gas export facilities are: Venture Global CP2, Cameron LNG Phase II, Sabine Pass Stage V, Cheniere Corpus Christi LNG Midscale 8-9, and Freeport LNG Expansion.

The outcomes reveal to which extent these projects are incompatible with meeting global climate goals and avoiding the worst impacts of the climate crisis. It also highlights how uncertain these projects are, making investments highly risky as they could be revoked by future administrations for climate incompatibility reasons.

The EU and several member states plan to increase US gas imports and European energy companies are signing long-term purchase agreements with US gas exporters, despite the fact that European gas demand is steadily declining and Europe needs to end gas use by 2035 in order to meet its international climate commitments.

Thomas Gelin, Greenpeace EU climate and energy campaigner, said: “Increasing US gas imports will deepen Europe’s dependence on the US, making the EU and national governments even more vulnerable to Trump’s political extortion. EU leaders must break free from fossil fuels and take control of Europe’s future by investing in a renewable, secure and peaceful energy system. A ban on all new fossil fuel projects in the EU would be the right first step, and the EU should certainly not consider funding oil and gas projects abroad.”

Key findings of the report

- All five liquefied gas projects fail the climate test that the US Department of Energy put forward in 2024 (under the Biden administration) to ensure approvals are consistent with the public interest. Each of them would result in a net increase in global GHG emissions regardless of the climate policy, energy demand, and technology assumptions underlying the calculation.

- Sustainability measures cannot make increasing US liquefied gas exports consistent with limiting warming to 1.5ºC. Even if major steps were taken to reduce the GHG emissions associated with LNG production through liquefaction—such as gas supply basin switching, LNG terminal methane abatement, and powering liquefaction with renewable electricity—increasing US liquefied gas exports from the Gulf Coast would still lead to global GHG emissions increases above the level consistent with the US Department of Energy’s most stringent climate mitigation scenario.

- Under a scenario with safer and more realistic constraints on the availability of carbon capture and storage (CCS), the climate impact of increasing liquefied gas exports would be even greater because deeper reductions in fossil fuel production would be necessary. The US Department of Energy’s most conservative CCS assumption under a Net Zero scenario surpasses feasible scale-up rates based on historical technology analogues and results in gas sector CCS volumes five times higher than in the International Energy Agency Net Zero Emissions scenario.

- While the methodology presented in the 2024 LNG Study is a major improvement upon previous federal analyses, it still fails to sufficiently account for emissions from large, accidental releases (such as “super-emitter” events), equipment malfunction, and malpractice. High rates of methane emissions during the ocean transport stage of the LNG supply chain are also not represented. Incorporating measurement-based data and more realistic assumptions would make clearer the immense climate impact of building new liquefied gas infrastructure, especially in the near term.

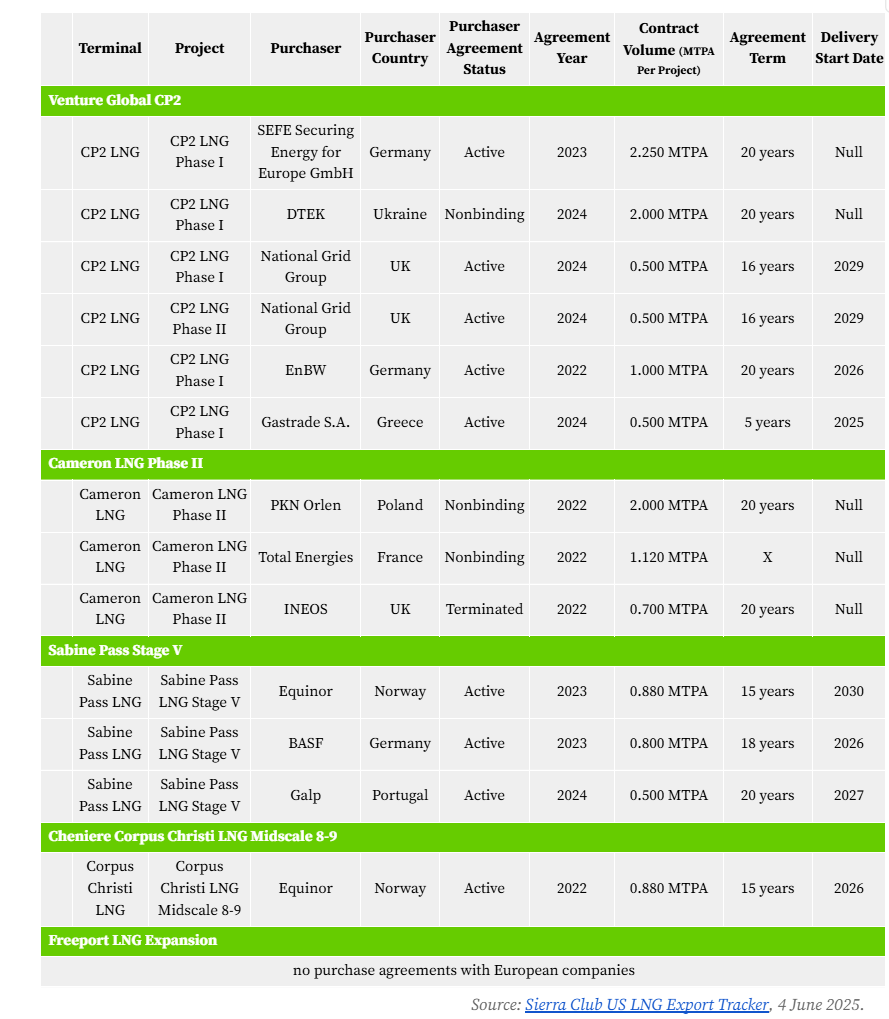

Source: Sierra Club US LNG Export Tracker, 4 June 2025.

European context

- Eleven companies based in Europe have already signed purchase agreements for four of the five liquefied gas export facilities analysed in the report (see table below). The US is already Europe’s largest supplier of liquefied fossil gas.

- Several of the purchase agreements have a duration far beyond 2035, the year by which Europe must have phased out fossil gas in order to meet its international climate commitments.

- The EU Affordable Energy Action Plan presented in February 2025 by the European Commission proposes to increase liquefied gas imports from countries other than Russia in the EU and promotes joint purchasing strategies and more long-term contractual engagement. In this Action Plan, the Commission even agrees to look into direct financial investments of the EU and its member states into LNG export infrastructure abroad (presumably in return for cheaper gas, the so-called Japanese model). This proposal ignores the fact that any new fossil fuel infrastructure is incompatible with limiting global warming to 1.5 °C degrees It also goes against a G7 agreement to end direct international public finance of the fossil fuel energy sector by the end of 2022 – although this came with a loophole for projects considered necessary for energy security.

- As Trump has turned liquefied gas into a geopolitical bargaining chip, pushing countries to lock-in their reliance on US liquefied gas in exchange for tariff relief, some Member States and industry have been pushing for the European Union to weaken its methane regulation in order to ease trade with US liquefied gas providers despite the fact this LNG comes from fracked fossil gas, which are associated with particularly high methane emissions. This regulation (which was adopted in 2023 and is currently being implemented) was originally intended as a mechanism to ensure only fossil gas with low levels of methane emissions at the point of production is imported into the EU.

- According to Global Witness, the EU’s imports of US liquefied gas are creating emissions that could cause more than €100 billion in damages from climate-driven extreme weather and disasters.

- The European gas decline has already started. Gas consumption in the EU declined by 20% between 2021 and 2024 (approximately 80 bcm) and the downward trend continues. According to an analysis by the Institute for Energy Economics and Financial Analysis (IEEFA), the EU’s target to replace up to 100 billion cubic metres of gas by 2030 is possible and remaining gas demand can be met without additional gas infrastructure or increased imports. The decline in overall gas consumption also has implications on the LNG market: Europe’s liquefied gas imports declined by 19% in 2024, and the average utilisation rate of the EU’s liquefied gas import terminals fell from 58% in 2023 to 42% in 2024.

- A recent UN report makes clear that fossil fuels are putting human rights at risk. According to the UN Special Rapporteur on Human Rights and Climate Change, states must act on the phase out of fossil fuels within this decade and stop all new fossil fuel projects.

Greenpeace EU demands

- The EU and its member states must put an end to new, long-term liquefied gas purchase agreements. The EU and its member states must impose a ban on all new fossil fuel projects, including on new liquefied gas import terminal projects, and commit to a full fossil gas phase-out by 2035 at the latest.

- The idea of direct financial investments of the EU and its member states into liquefied gas export infrastructure (as mentioned in the EU Affordable Energy Action Plan) must be nipped in the bud.

- The EU must resist pressure to give US liquefied gas a free pass and to weaken the EU methane regulation to ease trade with them. Instead, the EU methane regulation must be fully implemented and even strengthened to support the urgent reduction of methane emissions.

- The EU and its member states must accelerate the transition to affordable, independent and democratic renewable energy.

Context and methodology of the report

In December 2024, the Biden Administration’s Department of Energy issued a study of the socio-economic and environmental impacts of US liquefied natural gas (LNG) exports. One volume of the study demonstrates how to estimate the increase in global greenhouse gas (GHG) emissions caused by US LNG exports from individual terminals using company-specific data.

The US Department of Energy has a strong precedent of considering the GHG emissions impact of LNG terminals as part of its public interest determination required by the Natural Gas Act. While previous studies have assumed without justification that US LNG exports substitute 1-for-1 with other fossil fuels, the new study uses the Global Change Assessment Model, a well-established tool, to estimate the market and energy displacement effects of increasing US exports. Thus, the new study describes a more holistic approach that is better suited to assessing the climate impacts of US LNG exports in a world with soaring rates of renewable energy adoption and important, albeit uncertain, climate policy influences.

The new methodology implies a “climate test” as it shows how much companies would need to reduce production-through-liquefaction GHG emissions, relative to the sector average, to be considered “climate neutral.” We apply this methodology to a selection of planned projects and assess the scenarios and assumptions used.

FOR MORE INFORMATION, CONTACT:

Manon Laudy, media coordinator for the European Fossil-Free Future campaign, Greenpeace Netherlands, +336 49 15 69 83 / [email protected]

Greenpeace International Press Desk, +31 (0)20 718 2470 (available 24 hours), [email protected]

Greenpeace International – Surinameplein 118 1058 GV Amsterdam Netherlands