Luxembourg, 30 March 2022

Action Solidarité Tiers Monde (ASTM) and Greenpeace Luxembourg commissioned Nextra Consulting[1] to analyse the 2020 investments of the Fonds de compensation commun au régime général de pension (FDC) in terms of sustainability. The FDC stated previously to be “aware of its ecological, social and good governance responsibilities” as an institutional asset manager.[2] However, the analysis conducted by Nextra Consulting reveals that the FDC’s strategy is unambitious, insufficient, and non-transparent. In the course of 2022, the FDC will revise its investment strategy for the period 2023-2028 – a unique opportunity to significantly improve its sustainability performance. In this context, ASTM and Greenpeace propose concrete steps in terms of governance, investment strategy, divestment, and government action to advance Luxembourg’s sovereign pension fund on its path to becoming aligned with the Paris Agreement and respectful of human rights.

The FDC’s love for fossil fuels

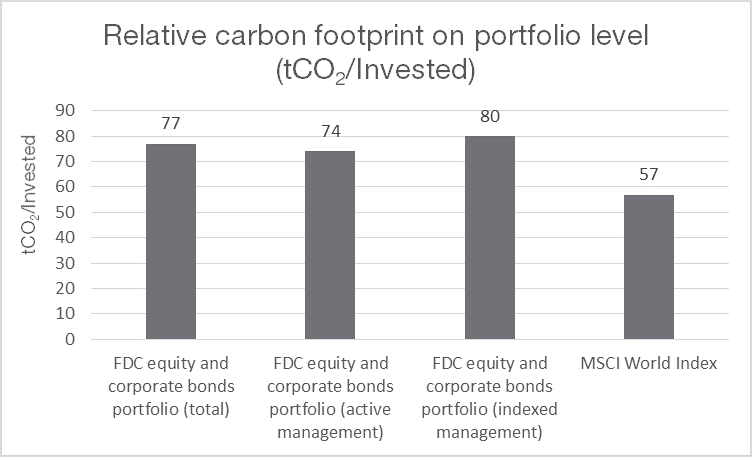

The FDC – a public institution of a country that has ratified the Paris Agreement – continues to invest citizen’s money in the fossil fuel industry. The FDC’s 2020 investments are associated with a potential temperature increase of 2.7°C by 2050, with two sub-funds even heading for a 6°C emissions pathway. The FDC finances 1,001,741 tons of carbon emissions through its portfolio, equivalent to 9% of Luxembourg’s direct greenhouse gas emissions. Moreover, the FDC invests in companies linked to controversial energy extraction business practices, such as arctic drilling, hydraulic fracturing (fracking) and the exploration of oil sands as well as shale oil and gas. These business practices are often linked to ecosystem damages and human rights violations.

The FDC’s blind spot: human rights

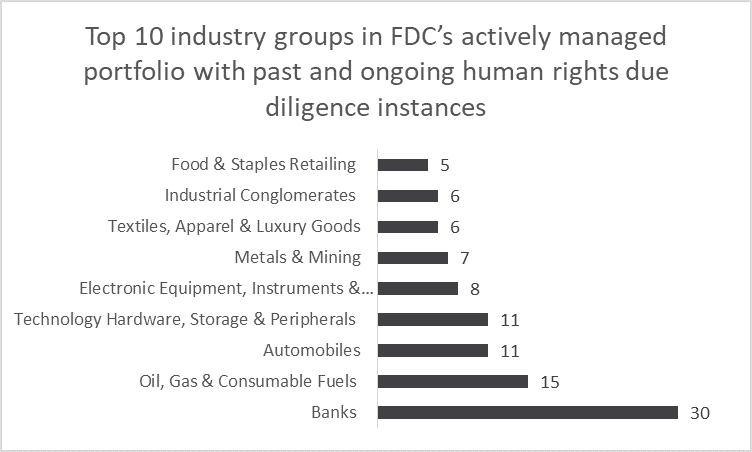

The FDC and its mandated asset managers fail to consider human rights in their sustainability approach and in their investment decisions. While the FDC often refers to its exclusion list to demonstrate its commitment to sustainability, this mechanism is not only non-transparent, but also insufficient. The Nextra analysis found that within the FDC’s actively managed portfolio, there are 282 reported cases by 196 companies of failures to conduct human rights due diligence. The financial sector is particularly concerned, as 30 out of these 196 companies are banks. Also, in terms of their impact on the Sustainable Development Goals (SDG), 47% of the companies in the FDC portfolio present a negative SDG rating. The FDC’s investments have a particularly negative impact on SDG 8 (Decent Work and Economic Growth), where 51% of the companies have a negative impact, and on SGD 12 (Responsible Consumption and Production), where 37% of the portfolio companies have a negative impact.

The financial risks of the FDC’s investment decisions

The exposure of the FDC’s investment portfolio to potential stranded assets is a matter of concern. Most of the companies in which the FDC invests show no concrete, measurable plan to transition to a sustainable business model. By investing in fossil fuels and other high-carbon assets as well as in countries considered as risk regions in the geopolitical sense, the FDC exposes itself to potential financial losses. The Russian invasion of Ukraine and the consequences for energy supply in Europe illustrate the risk that FDC takes when investing in companies that fail to transition. The current crisis has also clearly shown how financial and investment decisions can be used as a leverage to achieve political goals.

In this sense, ASTM and Greenpeace call on the FDC and the Luxembourg government to assume their responsibility for a sustainable pension fund. The FDC’s mandate, as set out in the law of 6 May 2004, needs to be clarified. To avoid any challenge on this point, the mandate should explicitly include sustainability criteria.

For the FDC to be sustainable, it must adopt and implement a global, coherent, and ambitious investment strategy for the fund as a whole, as well as for asset managers and their mandated sub-funds (both actively and passively managed). All investments must be aligned with the objective of the Paris Agreement of limiting global warming to 1,5°C as well as the International Bill of Human Rights.

[1] Nextra Consulting is an independent business and management consulting firm with a focus on sustainability (https://nextra-consulting.com/).

[2] Fonds de compensation (2020): Sustainable Investor Report (https://fdc.public.lu/dam-assets/publications/Sustainable-Investor-Report-2020-final-web-version-.pdf)

The full analysis conducted by Nextra Consulting is available here.