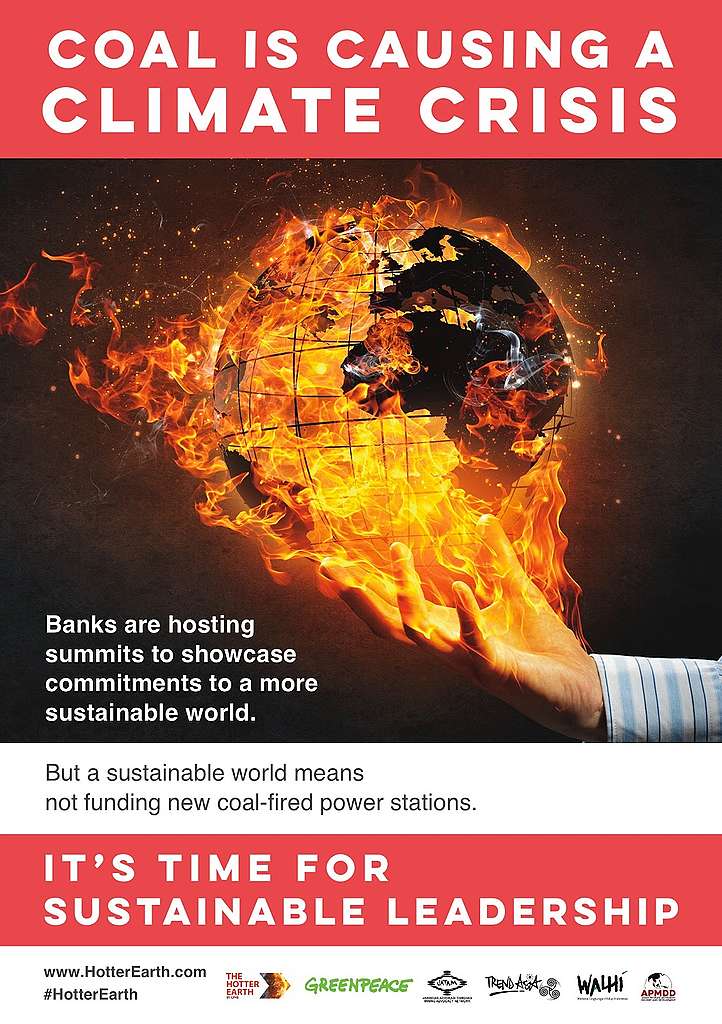

Environmental groups have scaled up a campaign targeting Malaysian banks over coal funding, by launching a major ad campaign.

In a full page advert in Saturday’s StarBiz, the groups, representing millions of people across Asia, highlight the role coal plays in driving the climate crisis, and call specifically on CIMB – but also Malaysia’s banking sector as a whole – to live up to sustainability promises and end finance to new coal projects.

CIMB Bank is already the target of an international climate campaign to highlight the disparity between the bank’s clean energy rhetoric and its continued funding of coal power. While CIMB has announced it will likely release a new climate policy this year, so far, there are no details.

See: CIMB is funding a hotter earth

“We are escalating this campaign because we are running out of time to solve the climate crisis,” said Didit Wicaksono, Climate and Energy Campaigner from Greenpeace Indonesia. “We simply cannot afford to build new coal-fired power plants, and we are urging Malaysia’s banks to live up to their promises and take on a leadership role in powering a cleaner healthier future for us all.”

“Simply put, new coal and action on climate are incompatible.”

According to new data released earlier this year, CIMB, Maybank and RHB provided US$4.9 billion in finance to the coal sector between 2010 and 2019. More than half of this was provided by CIMB, which lent over US$2.68bn to coal power over the period. This year, CIMB was part of a consortium which agreed to finance the construction of the highly controversial Jawa 9/10 coal plant in Indonesia.

Malaysian banks are falling behind a global trend, with over 110 financial institutions having already implemented policies to restrict or end coal finance. Last year, all three large Singaporean banks, UOB, DBS and OCBC, as well as Cathay Financial Holdings of Taiwan, announced new policies to end coal power project finance. In the past week, Korean banking giant KB Financial Group became the latest institution to exit coal power.

Bank Negara Malaysia, Malaysia’s Central Bank, has also repeatedly highlighted the critical importance of financial institutions managing climate risk.

| CIMB, Maybank and RHB’s lending to coal power and renewable energy* from 2010 to 2019 |

| Bank | Sector | Bond arrangement (US$m) | Lending (US$m) | Total (US$m) |

| CIMB | Coal | $2,445 | $240 | $2,685 |

| Maybank | Coal | $1,291 | $507 | $1,797 |

| RHB | Coal | $180 | $256 | $435 |

| Total | $4,917 |

“CIMB has an opportunity to be a clean and just energy leader in Southeast Asia,” said Merah Johansyah, National Coordinator of Jatam, Indonesian Mining Advocacy Network. “In doing so it will significantly reduce its exposure to stranded assets in the failing coal sector, as well as providing a critical boost to the millions of people affected by the climate crisis and by the scourge of air pollution.”

“CIMB clearly recognised clean energy is the future. But to safeguard this future, it must end coal investment now.”

Organisations supporting the campaign include Greenpeace Indonesia, TrendAsia, Indonesian Mining Advocacy Network Jatam and the Asian Peoples’ Movement on Debt and Development (APMDD)