If it weren’t such a bad idea in the first place, you could almost feel sorry for the Trans Mountain Expansion (TMX) pipeline. On Friday, the federal government cut it off from public funding following the revelation of massive cost overruns. Estimated construction costs are now $21.4 billion – four times the original price tag and likely to keep going up.

Finding over $10 billion in private sector funding to finish building TMX won’t be easy. The economics of this particular pipeline are much weaker than they were when Kinder Morgan abandoned the project, while the pressure on banks and pension funds to stop funding new fossil fuels and respect Indigenous rights is much stronger.

In an unintentionally-ironic twist, the crown corporation building TMX blamed increased costs partially on the “unforeseen challenges” of the wildfires and flooding that are fueled by climate change. Any investor who takes on the risk of supporting this project should foresee reputational risks on par with material climate risks.

Rising costs

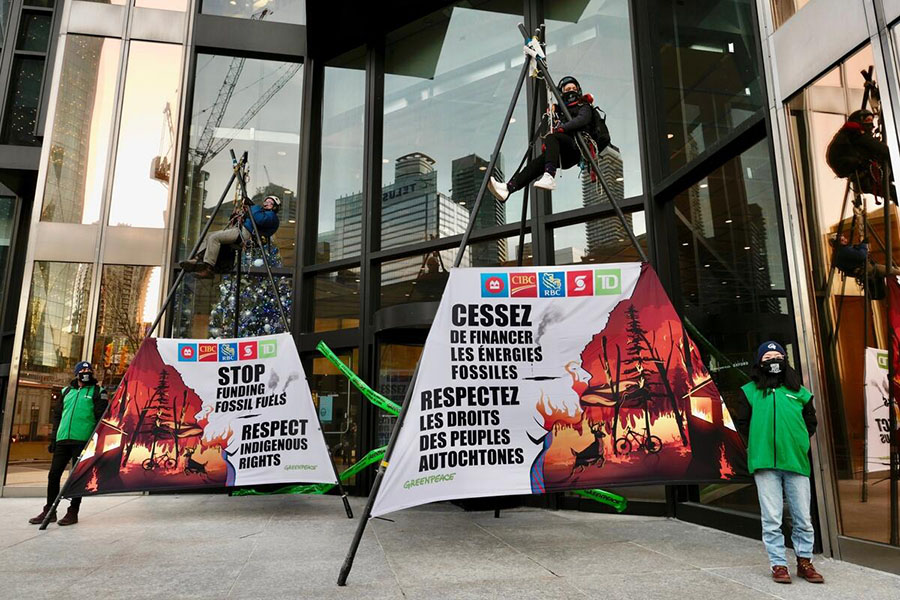

Before the Trudeau government bought the pipeline in 2018, Greenpeace Canada campaigned to cut off private sector funding to TMX. We even challenged the pipeline company’s securities filings on the grounds of inadequate disclosure of climate risks, forcing the company to admit that serious progress on meeting the Paris Agreement climate targets threatened their business model.

Yet once the project was publicly-owned, there was no need for private finance. Until now.

Kinder Morgan sold the controversial project to the federal government after estimated construction costs rose from an initial $5.4 billion estimate to $7.4 billion. By 2020, the price tag had risen to $12.6 billion, leading to an independent review from the Parliamentary Budget Officer which found that the pipeline would be a money loser if it was delayed by more than a year (it is) or if construction costs went up more than 10% (they are up an additional 70%).

Now that those costs have ballooned to $21.4 billion, the federal government appears to be getting cold feet. On Friday, Finance Minister Chrystia Freeland announced that it “will spend no additional public money on the project, and that TMC will instead secure the funding necessary to complete the project with third-party financing, either in the public debt markets or with financial institutions.”

Oil industry insiders were quick to cast doubt on whether the private sector would be willing to take the project on, with former Encana CEO Gwyn Morgan saying “In the commercial (real) world, no one’s going to finance a project running vastly over budget, with no firm remaining cost or start-up date.”

Climate risk

Oil lobbyists will argue that even if the pipeline itself loses money, it is still worth pursuing because of the spin-off benefits to the broader economy from expanding oil production and exports (i.e. government should continue to subsidize construction). These spin-off benefits only appear, however, in a world where oil demand continues to rise.

As the Parliamentary Budget Office noted in its review, TMX only made economic sense if no new climate policy measures are adopted beyond what was in place in 2020 (and hence global oil demand continues to rise. If global demand for oil drops – and hence the demand for shipping expanded oil production through the pipeline – then the net present value of the project goes steeply negative.

This finding echoed Kinder Morgan’s 2017 response to Greenpeace’s securities challenge, which stated:

“In recent years, a number of initiatives and regulatory changes relating to reducing GHG emissions have been undertaken by federal, provincial, state and municipal governments and oil and gas industry participants (including, for example, the decarbonization targets set forth in the Paris Agreement). In addition, emerging technologies and public opinion has resulted in an increased demand for energy provided from renewable energy sources rather than fossil fuels. These factors could not only result in increased costs for producers of hydrocarbons but also an overall decrease in the global demand for hydrocarbons. Each of the foregoing could negatively impact the Business directly as well as the customers of the Business that are shipping through its pipelines or using its terminals, which in turn could negatively impact the prospects of new contracts for transportation or terminalling, renewals of existing contracts or the ability of the Business’ customers and shippers to honour their contractual commitments.” (Pages 34-35 of the revised prospectus).

Since those reviews, the federal government has taken new actions, including a commitment to ban the sale of fossil fuel-powered cars and light trucks by 2035 (as have many other countries), along with a host of other new measures that will cut demand for oil as part of its commitment to achieve net-zero greenhouse gas emissions by 2050.

Adding to the risk of stranded assets, in 2021 the International Energy Agency (IEA) published a roadmap to net-zero that found no need for new fossil fuel projects. In the IEA’s scenario, global oil production drops by 75%, with high-cost sources (like Canada’s oil sands) absorbing the bulk of those reductions.

What does all this mean? Any bank, pension fund or investor who chooses to bankroll TMX is betting on climate disaster.