Tax is a hot topic, and as the cost of living rises, prompting protests and hitting the most vulnerable hardest, it’s getting hotter. The hopeful news: governments are negotiating terms for a new UN tax convention this month. This is an opportunity to reshape economic structures in favour of fairness and wellbeing for us all. Agreeing new global tax rules could put economic justice and wellbeing at the forefront of global policy, which is where it should be!

Coming from a rural part of South Africa, Lehurutshe, near the border of Botswana and growing up in a household where both my parents were teachers earning a humble salary, I saw firsthand the sacrifices of my parents and the struggles of my community to provide their children with the basics. The students at the schools that my parents taught at had even less, while billionaires fly their private jets from city to city, evading taxes that they should rightfully be paying.

Governments must get their priorities straight. Piling taxes on the average person while multinationals and the ultra-rich get away with not paying their fair share is not the solution for governments to make the money needed for education, water, health and climate action. Such inequity in the taxation system only serves to perpetuate inequality and hinder the future prospects of generations like mine and those to come. Recent protests in Kenya highlighted people’s increasing frustration with unfair tax policies that disproportionately burden those already struggling.

Extreme concentration of wealth and power is a serious problem

Each year, an increasing share of global wealth ends up in the hands of a few, exacerbating economic and political inequalities, undermining democracies, and limiting access to basic services. Recent statistics show that global public debt has reached a record US$97 trillion. This means that 3,3 billion people, more than 40% of the world’s population, live in countries where our governments are forced to spend more on public debt interest payments than basic services like education or healthcare. It doesn’t have to be this way.

Time to change unfair global tax rules

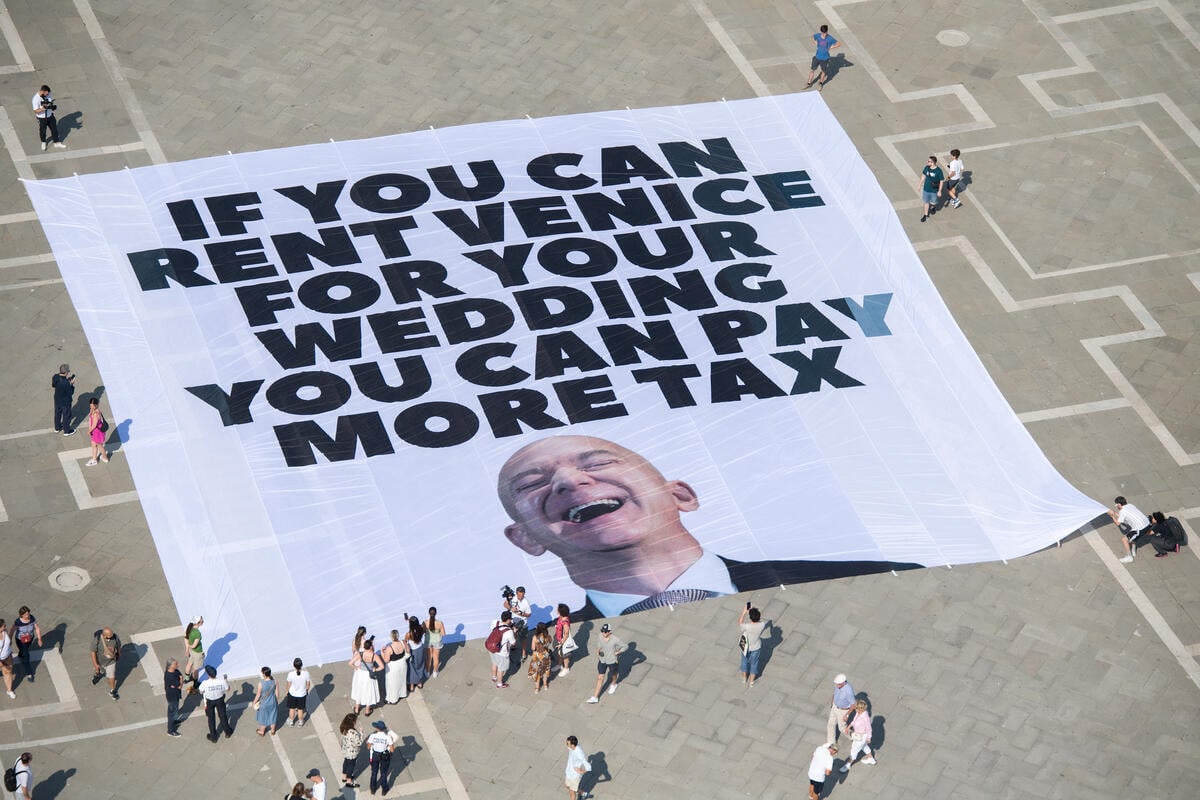

The current global tax structure, dominated by a small group of wealthy countries and powerful multinational corporations, allows for tax evasion and abuse. For example, it’s morally indefensible that billionaires – a group disproportionately responsible for the climate and biodiversity crises – are afforded tax breaks while those most impacted by environmental damage carry a higher tax burden.

But this year, a new UN tax convention is being negotiated, thanks to a group of African UN member states who made history in March 2023 by declaring the existing global tax structure unjust and demanding change. This is a historic opportunity to fix unfair global tax rules by transferring decision-making power from a few rich OECD (Organisation for Economic Cooperation and Development) countries to ALL the member states of the UN, where EVERY COUNTRY HAS A VOTE.

Reforming the outdated and unfair global tax structure can help reclaim the US$480 billion dollars lost due to global tax abuse by multinational corporations and the ultra-rich every year. And instead put funds to good use building a future where everyone enjoys access to essential services and ensuring our planet is protected for future generations. Taxing the super-rich and the mega polluters, rather than the poor, aligns with environmental justice principles and ensures those responsible for environmental damage bear the greatest responsibility. It’s about time!

Let’s work together to bring the wellbeing of the global majority to the forefront of global policy. It’s time to dismantle old colonial structures and build a fairer future for all. I urge you to take a stance today and support taxing those who can afford it and deserve to be held accountable for the pollution and other atrocities they perpetuate in our world.

We’re asking governments to put wellbeing at the top of the agenda. Join our global movement and let’s demand wellbeing for all!

Join our global movement!Amrita Ranjit, Social Media Specialist at Greenpeace Africa