Russia’s invasion of Ukraine has kicked off a stampede to build new LNG terminals that will not help Europe during their current energy crisis.

Methane gas is converted into Liquefied Natural Gas (LNG) and then loaded onto tankers at large, complex export terminals. The scale of LNG exports is limited by the capacity of these export terminals – the more that get built, the more U.S. methane can be shipped around the world.

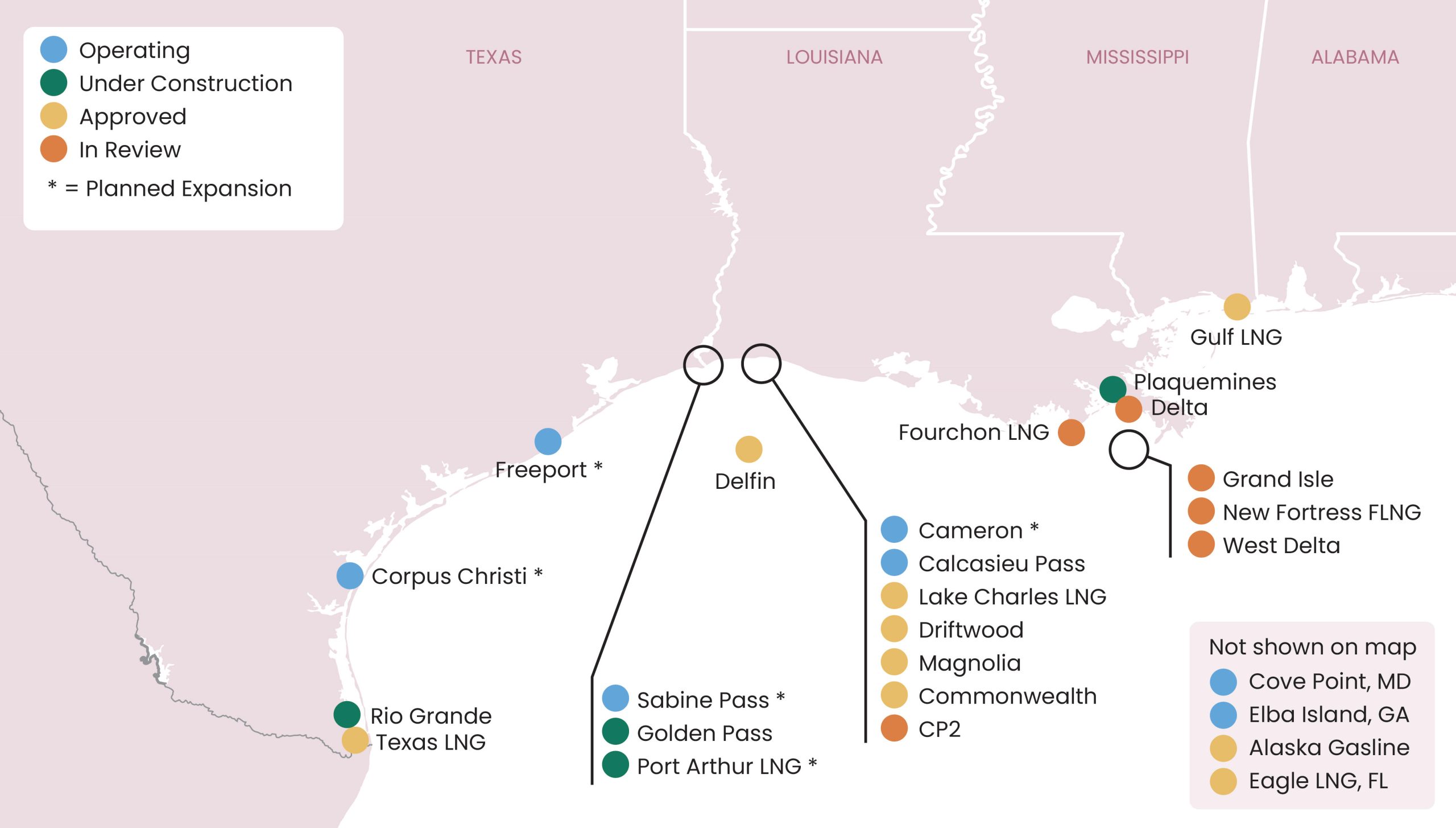

The first LNG export terminal built on the U.S. Gulf Coast was Cheniere Energy’s Sabine Pass, which began operations in 2016 and is located on the border between Louisiana and Texas. Today, there are seven operating export terminals – five on the Gulf Coast and two on the Atlantic coast – with a total peak liquefaction capacity of 14 billion cubic feet per day (bcf/d).

Russia’s invasion of Ukraine has kicked off a rush to build new and expanded export terminals that could greatly increase U.S. exports and drilling. The map and the tables below outline the numerous projects that are under construction, or that are still seeking financing or approval. Building an export terminal can cost tens of billions of dollars, and as a result, these projects must obtain significant financing packages – known as a “final investment decision” (FID) – to begin construction.

To reach FID, the project needs to show investors that it has obtained the proper permits and has lined up the necessary construction and gas supply contracts. The most important permits to build and operate an export terminal are those from the Federal Energy Regulatory Commission (FERC) and the Department of Energy (DOE). Most crucially, lenders want the project to have already secured long-term contracts with the purchasers of the LNG. Having these contracts in hand guarantees future sales and cash flow sufficient to cover the debt payments. There is a fierce competition among the proposed projects to lock down long-term sales contracts, and hence be the first to reach FID.

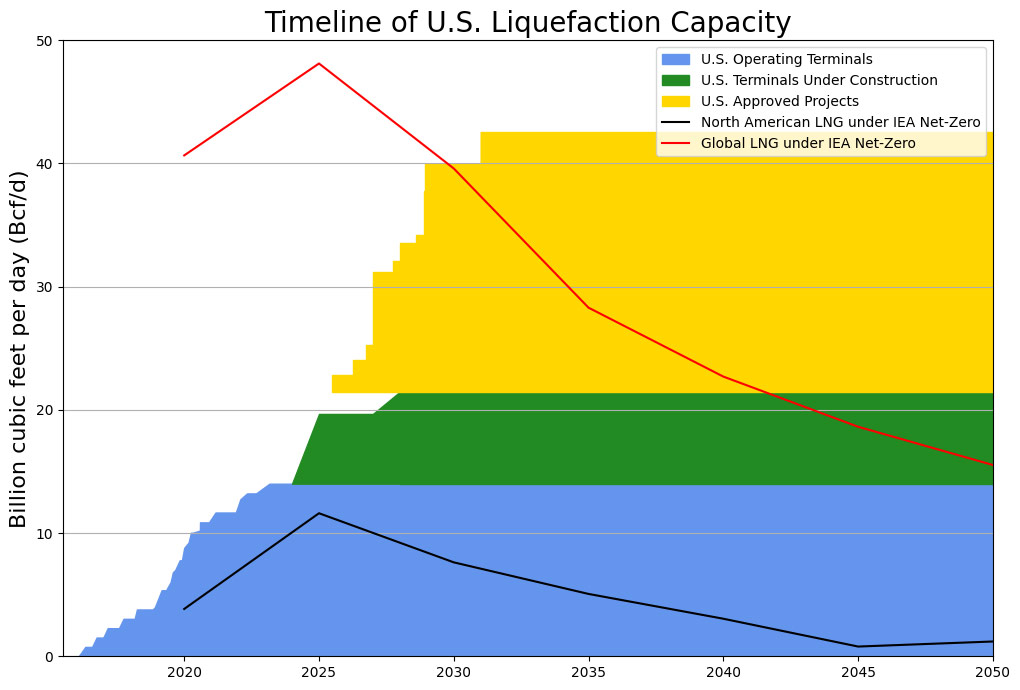

This stampede to build new LNG terminals will not help Europe during the current energy crisis as any new terminals would take years to come online and are not needed to satisfy Europe’s short-term demand for gas. However, any build out of new terminals would be inconsistent with pathways to limit global warming to 1.5C. The IEA’s Net-Zero Emissions (NZE) Scenario estimates that LNG exports must peak in 2025, both globally (at 48 bcf/d) and from North America specifically (at 11.6 bcf/d). Following the peak, North American LNG exports would decline almost to zero by 2045.

The problem is that the peak capacity of the seven operating U.S. terminals is already higher than the North American NZE estimate (see figure below). Adding the three LNG terminals under construction would increase U.S. export capacity to over 20 bcf/d. If all the approved projects and expansions were built it could double export capacity to over 42 bcf/d. By 2030, U.S. LNG by itself could be larger than the NZE estimate for the entire global LNG trade. While all of these approved projects may not ultimately be built, it’s clear that this LNG build-out puts our climate targets at risk.

The tables below show the status of the various LNG export terminal projects in the U.S. as of January 2024. We also note that there are also several LNG export projects that have been proposed in Mexico that would source their methane gas from U.S. production regions.

| Operating Export Terminals | ||||

| Project | State | Owners | Status | Peak Capacity (bcf/d) |

| Sabine Pass | Louisiana | Cheniere | Operating Additional expansion in pre-filing with FERC |

4.55 TBD |

| Corpus Christi | Texas | Cheniere | Operating Stage 3 Under Construction Additional expansion in pre-filing with FERC |

2.4 1.51 TBD |

| Freeport | Texas | Freeport LNG | Operating Train 4: FERC approved, awaiting FID |

2.38 0.67 |

| Cameron | Louisiana | Sempra LNG, Mitsui Group, TotalEnergies, Mitsubishi Corp, NYK | Operating Train 4: FERC approved, awaiting FID |

1.98 0.89 |

| Cove Point | Maryland | Dominion, Berkshire Hathaway, Brookfield Asset Management | Operating | 0.76 |

| Elba Island | Georgia | Kinder Morgan, Blackstone | Operating | 0.36 |

| Calcasieu Pass | Louisiana | Venture Global | Operating | 1.58 |

| Under Construction Export Terminals | ||||

| Project | State | Owners | Status | Peak Capacity (bcf/d) |

| Golden Pass | Louisiana | Qatar Petroleum, ExxonMobil | Under Construction | 2.39 |

| Port Arthur | Texas | Sempra, ConocoPhillips | Trains 1&2 – Under Construction Trains 3&4 – Under FERC Review |

1.8 TBD |

| Plaquemines | Louisiana | Venture Global | Under Construction | 3.16 |

| Rio Grande | Texas | Next Decade | Under Construction | 3.61 |

Approved terminals have received permits from FERC and DOE (or in some cases, MARAD), but have not yet reached FID or begun significant construction. DOE recently announced a policy change of no longer approving extensions to the seven-year period when these projects must begin exporting. This change potentially puts many of the approved projects at risk of not completing construction before the deadline expires.

| Approved Export Terminals awaiting FID | ||||

| Project | State | Owners | Status | Capacity (bcf/d) |

| Lake Charles | Louisiana | Energy Transfer | FERC approved, but in 2023 DOE denied a request for an export permit extension beyond 2025, putting the project in jeopardy | 2.2 |

| Driftwood | Louisiana | Tellurian | FERC approved, some construction has begun, but project lost suppliers and FID has been long-delayed | 3.64 |

| Texas LNG | Texas | Texas LNG | FERC Approved, awaiting FID | 0.56 |

| Magnolia | Louisiana | Glenfarne Group | FERC approved, awaiting FID | 1.2 |

| Eagle LNG | Florida | Energy & Minerals Group | FERC approved, awaiting FID | 0.13 |

| Delfin LNG | Gulf of Mexico offshore | Fairwood, Enbridge | MARAD approved, awaiting FID | 1.6 |

| Commonwealth | Louisiana | Commonwealth LNG | FERC approved, awaiting FID | 1.21 |

| Alaska Gasline | Alaska | Alaska Gasline Dev Corp | FERC approved, awaiting FID | 2.55 |

| Gulf LNG | Mississippi | Kinder Morgan +others | FERC approved, awaiting FID | 1.43 |

| Export Terminals Under Review | |||

| Project | State | Owners | Status |

| Grand Isle FLNG | Gulf of Mexico offshore |

New Fortress Energy | Under MARAD review, self-financed |

| CP2 | Louisiana | Venture Global | Under FERC review |

| West Delta | Gulf of Mexico offshore | West Delta LNG | Under MARAD review |

| Delta | Louisiana | Venture Global | FERC pre-filing |

| Fourchon | Louisiana | Energy World | FERC pre-filing |

| Grand Isle LNG | Gulf of Mexico offshore | Grand Isle LNG | Under MARAD review |

Notes: Project status information is taken from FERC, MARAD, company press releases, and media reporting. Capacity values are taken from the US EIA’s liquefaction database. For existing and under construction terminals we use “peak nameplate capacity”, whereas for approved terminals we use “proposed design capacity.” Project links go to the Global Energy Monitor wiki. The tables do not include various other proposed projects that have not yet advanced to review.

For operating terminals the timeline in the figure is given by the EIA’s reported In-Service and Start of Commercial Service dates for each liquefaction train. For approved terminals and those under construction we estimate start dates based on media reports and estimates from the Sierra Club LNG tracker, although we note that all such dates are highly uncertain and should be considered rough estimates. It is possible that many approved terminals will never be built.

(Return to LNG 101 main page)